Understanding Delivery Notes: More Than Just Paperwork

The delivery note is often the overlooked stepchild in a company's document stack. While invoices receive the highest attention due to direct cash flow implications, delivery notes are frequently dismissed as mere "packaging inserts." However, this perspective is not only outdated—it's risky.

In an era where Germany leads Europe in return rates and logistics costs are exploding, the delivery note becomes the decisive document for a successful customer relationship. It's more than just a list of items; it's the proof of successful consultation and correct order processing.

In this article, you'll learn not only how to create a legally compliant delivery note, which mandatory fields are essential, and how the retention periods are changing from 2025. We'll also examine what most guides ignore: how errors in delivery notes often originate during product consultation, and how modern AI-powered customer service solutions are closing this gap.

Free Delivery Note Templates: Instant Download

Before we dive deeper, let's provide you with immediate assistance. If you're under time pressure and need to create a delivery note quickly, use our free templates.

Available Downloads:

- Download: Delivery Note Template (.docx for Word)

- Download: Delivery Note Template (.xlsx for Excel)

- Download: Delivery Note Template (PDF)

Definition & Function: What Is a Delivery Note?

A delivery note, also known as a goods accompanying document or packing slip, is a document that provides information about the contents of a shipment. According to Lexware, it serves as the interface between the sender's warehouse and the recipient's goods receiving department.

The Three Core Functions

- Control Function: The recipient can immediately verify: "Is what's in the package what I ordered?"

- Proof Function: With the recipient's signature on the delivery note (or the carrier's digital handheld scanner), receipt of the goods is confirmed. This is legally relevant for the transfer of risk.

- Information Function: It helps internal departments (e.g., accounting) to assign the subsequently arriving invoice.

The Pre-Sales Connection

Most definitions end here. However, strategically viewed, the delivery note is the end result of your consultation process. Imagine: A customer is looking for a spare part. Your consultation (whether human or AI) identifies Part X. The customer orders Part X. The delivery note lists Part X.

If the consultation was inaccurate, the ordered part appears on the delivery note, but not the needed one. The delivery note is formally correct, but the process has failed. A perfect delivery note therefore doesn't begin in the warehouse, but with AI product consultation. This connection between accurate consultation and fulfillment success is what separates excellent businesses from mediocre ones.

Is a Delivery Note Mandatory? Legal Foundations

Many entrepreneurs ask: "Do I absolutely have to create a delivery note?"

The short answer is: No, there is no legal obligation to issue a delivery note. According to IHK, neither the German Commercial Code (HGB) nor the Fiscal Code (AO) explicitly require this document. A delivery could theoretically occur with just the goods themselves.

Why You Should Still Do It (Best Practice)

Although there's no obligation, the delivery note has established itself as a commercial standard, as confirmed by Clean Invoice.

- Burden of Proof: In case of disputes ("I only received 3 instead of 5 packages"), the countersigned delivery note is your most important evidence in court. Without it, it's one word against another.

- Professionalism: B2B customers expect a delivery note for their own goods receiving inspection. Without one, the company appears disorganized.

- Industry Requirements: In certain industries or framework agreements, issuance may be contractually agreed upon.

Mandatory Fields: Delivery Note Checklist

Since there's no legal obligation to create one, there are also no strict legal form requirements like those for an invoice (§ 14 UStG). Nevertheless, businesses follow the minimum requirements for commercial letters to avoid misunderstandings, as noted by IHK guidelines.

To ensure your delivery note template looks professional and serves its purpose, the following elements should be included:

Basic Data Requirements

- Name and Address of the Supplier: Your company letterhead

- Name and Address of the Recipient: Delivery address (may differ from the billing address!)

- Issue Date: When was the document created?

- Shipping Date/Delivery Date: When did the goods leave the warehouse?

- Delivery Note Number: A sequential number for unique identification (important for the subsequent invoice)

Product Data (Where Errors Happen!)

- Quantity: Piece count, weight, or volume

- Standard Trade Description of the Goods: This is where the greatest optimization potential lies

Examples of description quality:

- Poor: "Cable"

- Good: "HDMI Cable 2.1, 2m, gold-plated connectors, Art. No. 12345"

Why does this matter? The more precise the description, the easier the inspection for the recipient. Vague descriptions often lead to support inquiries ("Is this really the cable for my monitor?"). This is where automated consultation makes a significant difference by capturing exact specifications from the start.

Optional but Recommended Fields

- Customer Number / Order Number: Reference the customer's order ("Your order from...")

- Back Orders: Note if items are missing and will be delivered later

- Signature Field: "Goods received undamaged on: _______ Signature: _______"

Sender, receiver, dates, and reference numbers form the foundation

Precise product descriptions prevent support inquiries

AI-integrated workflows achieve near-zero fulfillment errors

Delivery Note vs. Invoice: The Key Differences

These documents are often confused or lumped together. However, the distinction is essential for your accounting and for understanding delivery note requirements.

| Feature | Delivery Note | Invoice |

|---|---|---|

| Primary Purpose | Documentation of goods receipt/shipment | Payment request |

| Recipient | Warehouse / Goods Receiving | Accounting / Finance Department |

| Prices | Usually without prices (quantities are the focus) | Mandatory with prices (net, gross, VAT) |

| Mandatory? | No (commercial practice) | Yes (required by tax law) |

| Timing | Accompanies the goods (or sent digitally in advance) | Often follows separately by mail/email |

Special Case: The Delivery Invoice

It's possible to combine both documents. If your delivery note contains all the mandatory tax information of an invoice (tax number, VAT ID, tax rates, prices, etc.) and is also designated as an invoice, you save yourself a document. This is common with smaller online shops or direct sales. But be careful: then the stricter retention periods for invoices also apply!

Step-by-Step: Creating Delivery Notes Correctly

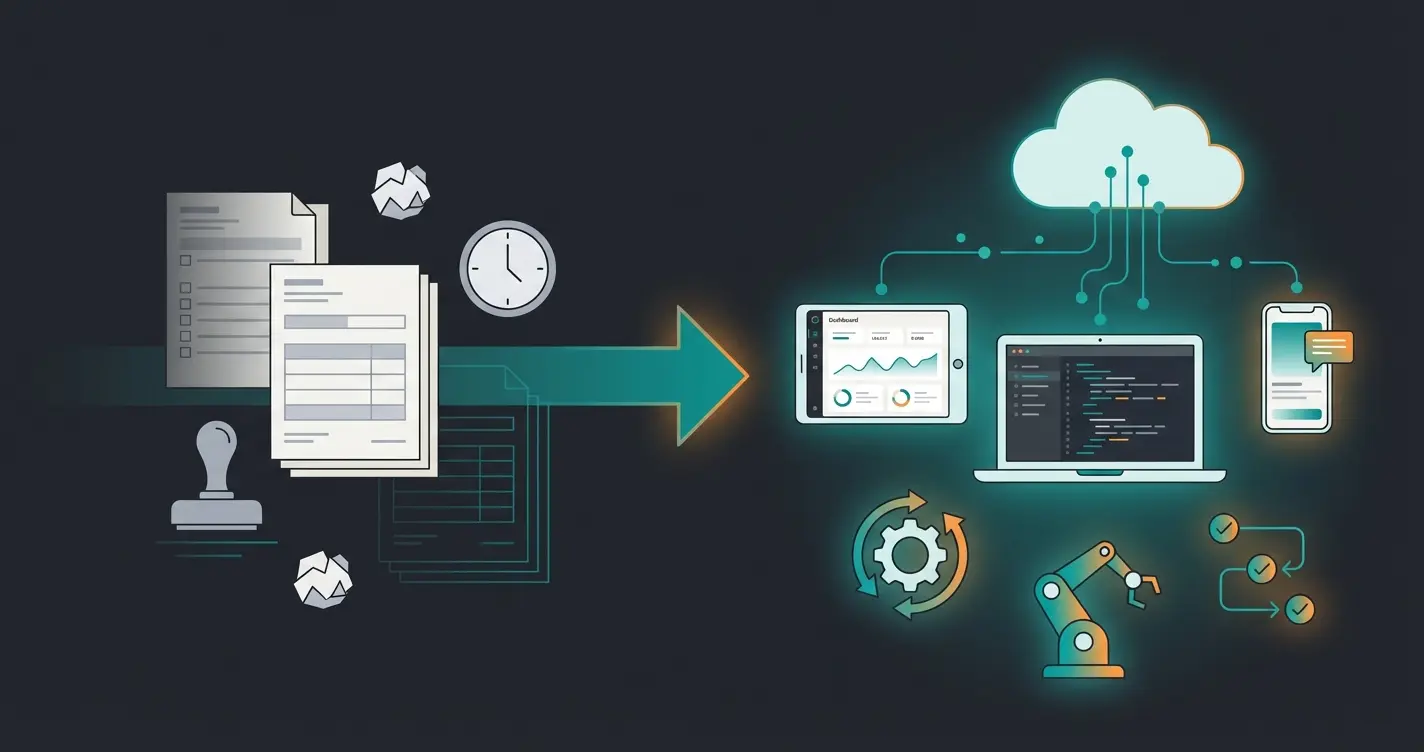

How do you actually create this document in practice? We compare three approaches—from manual startup to fully automated AI solutions.

Option A: Word & Excel (The Manual Way)

For entrepreneurs just starting out and shipping fewer than 10 packages per month, this is the most cost-effective approach. According to OhneHausverwaltung, it offers full layout flexibility at no cost.

- Advantage: No software costs, complete layout flexibility

- Disadvantage: High error susceptibility. Addresses must be copied (copy-paste errors), article numbers manually typed. No automatic continuation of delivery note numbers.

- Risk: If you shift a row in Excel, Customer A receives Customer B's goods. This appears unprofessional and causes return costs.

Option B: Traditional Delivery Note Software

From a certain volume (approx. 50 shipments/month), software (like Lexware, sevDesk, weclapp) becomes indispensable. These delivery note programs transform quotes or orders into delivery notes with a mouse click, with data transferred 1:1.

- Advantage: Time savings, GoBD compliance, professional design

- Gap: These systems are "unintelligent." They only transfer what's in the order. If the order contains the wrong part due to incorrect consultation, the delivery note will also be created incorrectly.

Option C: The AI-Powered Workflow (The Future)

This is where your competitive advantage comes into play. A delivery note shouldn't be the result of an administrative act, but the result of an intelligent data chain. Companies that hire an AI employee for their consultation process see dramatically different results.

The Scenario:

Customer asks the AI chatbot: "I need a gasket for my coffee machine Model X, year 2018."

The AI analyzes technical specifications and identifies the only compatible spare part (not just by keyword, but by technical compatibility).

The AI transfers the exact SKU (Stock Keeping Unit) to the ERP system.

The delivery note is automatically created with 100% accurate data.

Return rates drop to near zero as human transfer and consultation errors are eliminated.

The Bottom Line: While Excel costs time and traditional software only manages data, an AI workflow ensures quality assurance before the delivery note is even printed. The AI Employee Flora demonstrates how this works in practice for product consultation scenarios.

See how AI-powered product consultation ensures accurate orders from the first customer interaction—reducing returns and support costs by up to 80%.

Start Free TrialRetention Periods: New Legal Requirements from 2025

A topic where much outdated information circulates online is retention periods. Here you need to distinguish precisely what function your delivery note fulfills.

Basic Rule: 6 Years (Commercial Letter)

If the delivery note serves only as a "received commercial letter" (for the customer) or "sent commercial letter" (for the supplier) and has no accounting function, the period is 6 years, as confirmed by D-velop and Smart Store. The period begins at the end of the calendar year in which the delivery note was received/sent.

Exception: Accounting Document

As soon as the delivery note serves as an accounting document (e.g., because the invoice references it: "See Delivery Note No. XY" or it contains notes for accounting), the retention period was previously 10 years.

According to Haufe and D-velop's compliance guidelines, this means delivery notes that function as accounting documents now only need to be archived for 8 years starting in 2025.

Retroactive Application: As reported by Dr. Datenschutz, this also applies to documents whose period had not yet expired on January 1, 2025. You can therefore clean up your archives earlier than previously planned.

Digitization & GoBD Compliance

Whether 6 or 8 years: if you create (or receive) the delivery note digitally, you must also archive it digitally. According to Ecovis and DocuWare, printing it out and deleting the file is not GoBD-compliant. The digital original must remain unalterable and readable.

Common Errors and the Returns Problem

Germany has one of the highest return rates in Europe. In the fashion sector, up to 50% of goods are returned according to Neocom, but even in the B2B sector, incorrect deliveries cause enormous costs (approximately €15 process costs per return + value loss), as documented by Atamya.

Many of these returns originate from poor data on the delivery note or in the pre-order phase.

Error 1: Unclear Product Descriptions

Studies show that "product does not match description" is one of the main reasons for returns. Companies using AI product consultation have found effective solutions to this challenge.

Solution: Use the delivery note not only for internal codes, but print clear, understandable item descriptions. An AI can help "translate" cryptic warehouse codes into customer-friendly descriptions.

Error 2: Discrepancy Between Consultation and Delivery

The customer orders what was recommended to them. If the recommendation (human error) was wrong, the delivery note is correct relative to the order, but wrong relative to the need. This is where product consultation powered by AI makes a critical difference.

Solution: The integration of AI consultation ensures that the customer's technical requirements (input) are exactly matched with warehouse data (output).

Error 3: Missing References

The delivery note contains no customer order number. At the customer's goods receiving department, the package cannot be assigned → refusal to accept → return.

Solution: Define mandatory fields in your delivery note software that block creation without a reference number.

| Creation Method | Time per Note | Error Risk | Link to Consultation | Return Rate |

|---|---|---|---|---|

| Excel Template | 15-20 min | High (manual entry) | None | 8-12% |

| Standard Software | 3-5 min | Medium (data transfer) | Manual | 4-6% |

| AI-Integrated Solution | <1 min | Very Low (automated) | Automatic | <1% |

The Electronic Delivery Note: A Paperless Future

While the e-invoice becomes mandatory in the B2B sector from 2025 according to IHK regulations and Handwerksblatt, the electronic delivery note is following suit. Projects like Cloud4Log, documented by Prismat, show where the journey is heading.

Advantages of Digital Delivery Notes

- Real-Time Data: As soon as the goods are scanned, the customer has the data in their system.

- No Paper Loss: Torn or lost slips are a thing of the past.

- Faster Invoicing: Since the delivery confirmation is immediately available digitally, the invoice (and thus the payment run) can be triggered faster, as noted by Sorba.

For businesses, this means: those who still rely on Word templates today will have problems tomorrow connecting to the digital interfaces of major logistics providers and customers. The step to a software or AI solution is therefore also an investment in future viability. Integration with AI employees ensures seamless data flow from consultation to fulfillment.

FAQ: Frequently Asked Questions

It's not legally mandatory, but for evidentiary value (that the goods arrived) the signature is essential. Without a signature, you have a weak position in case of disputes.

Yes. Many companies today send the delivery note in advance by email (as PDF) to the customer's goods receiving department. The package itself then often contains only a packing slip. Ensure GoBD-compliant archiving of the email.

No, this is uncommon. Prices belong on the invoice. The delivery note is often also checked by warehouse employees who shouldn't see the purchase conditions. Exception: For deliveries to non-EU countries (customs), value declarations on corresponding documents (proforma invoice) are necessary.

No government penalty threatens, but you risk annoyed customers and chaos in your own warehouse management. Additionally, you lose the simplest proof of the service provided.

AI consultation systems capture exact technical requirements from customers at the inquiry stage, then automatically populate delivery notes with precise specifications. This eliminates human transcription errors and ensures the 'customer language' matches the 'warehouse language' perfectly.

Conclusion: From Document to Strategic Tool

Creating a delivery note isn't rocket science, but it's a process that requires precision. Whether you use a delivery note template or professional software: pay attention to the mandatory fields and correct archiving (remember the new 8 years!).

But if you really want to set up your business efficiently, don't view the delivery note in isolation. It's the last link in a chain that begins with the customer inquiry. Error-free delivery notes are the result of error-free consultation.

Use modern technologies and AI to close this chain—for fewer returns and happier customers. An AI chat solution integrated with your fulfillment process can transform how you handle the entire customer journey from inquiry to delivery.

Businesses that have implemented AI employee solutions report dramatic improvements in order accuracy and customer satisfaction. The future of logistics documentation isn't just digital—it's intelligent.

Ready to transform your consultation-to-fulfillment pipeline? Book a free initial consultation to discover how AI lead generation and intelligent product matching can eliminate errors before they reach your delivery notes.

Join leading businesses using AI consultation to achieve near-zero fulfillment errors. Start with error-free delivery notes that begin at the first customer interaction.

Get Started Free