Why Your Next ERP Cannot Be Just an Admin Tool

The term ERP for Mittelstand is undergoing a radical transformation. For a long time, Enterprise Resource Planning (ERP) was considered a necessary evil of administration: a gigantic data storage system for invoices, inventory levels, and payroll accounting. The selection criteria were rigid: "Can it export to DATEV?", "Does inventory valuation work?", "Is it GoBD-compliant?"

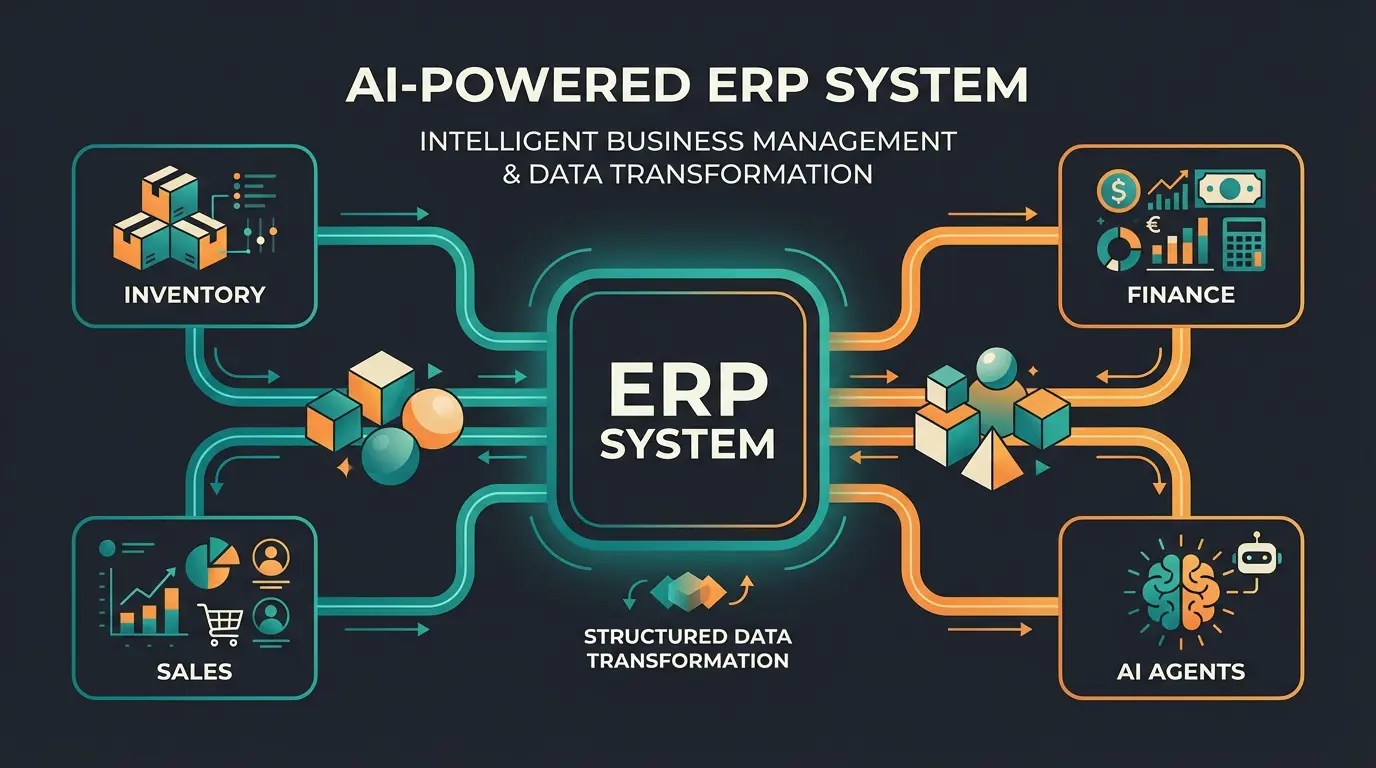

However, in 2026, this is no longer sufficient. The German Mittelstand – especially the "Hidden Champions" in manufacturing and wholesale sectors – faces a new challenge. It's no longer just about storing data (System of Record), but about making this data intelligently usable (System of Intelligence), as noted by Centium.

While conventional comparison portals still check off pure feature lists, reality shows a different urgency: The integration of Artificial Intelligence (AI) and a system's ability to serve as a "Single Source of Truth" for sales and consultation processes. A modern ERP must be capable of answering complex product questions from a sales engineer in seconds, rather than making them click through ten submenus. This shift connects directly to how businesses can leverage AI product consultation to transform their customer interactions.

This article does not deliver a cookie-cutter comparison. It is a strategic guide for mid-sized companies (focus on 100–500 employees) who want to understand how to transform their ERP landscape from a "data grave" into an "intelligent advisor." We illuminate market leaders, analyze the cost structure, and demonstrate why data accessibility is the most important selection criterion of the coming decade.

The Current State: What Defines the German Mittelstand

Before we discuss software, we need to talk about the reality in mid-sized companies. Unlike large corporations that can often standardize processes ruthlessly, the Mittelstand thrives on flexibility and customer proximity.

The Three Major Pain Points in ERP Usage

Current analyses and surveys in the environment of ERP for 100-500 employees reveal recurring patterns:

- Product Complexity (Variant Diversity): Many mid-sized companies do not manufacture standard goods but highly configurable products (e.g., mechanical engineering, special components). A standard item master often falls short here. The consequence: Sales staff must carry technical knowledge in their heads because the ERP often only hides dependencies ("Does Motor A fit Flange B?") cryptically in bills of materials, as highlighted by OMR.

- The "Data Swamp" Problem: Over the years, grown systems (often on-premise installations of older Navision or SAP versions) have accumulated data volumes that are inconsistent. Duplicates and unstructured free-text fields make automation nearly impossible according to LeanDNA analysis.

- The Discrepancy Between Administration and Consultation: The ERP is often only "loved" by accounting and purchasing. Sales often hates it because it's slow, works poorly on mobile, and doesn't deliver quick answers, as noted by Planat.

Why the Old Selection Process Is Dead

In the past, companies created requirement specifications with 500 lines where functions like "printing delivery notes" were checked off. Today, these basic functions are hygiene factors – every serious system can do that. The new focus lies on connectivity and AI-readiness. The question is no longer: "Can the ERP manage inventory levels?" but "Is the data structure clean enough that an AI agent can tell my sales representative on the phone when the goods will arrive at the customer, taking into account current delivery bottlenecks?" This is supported by insights from Softengine.

Mid-market companies now rank AI capabilities as top-3 selection criteria

ERP implementations exceeding budget due to poor data quality

AI-enhanced ERP consultation vs. traditional manual lookup

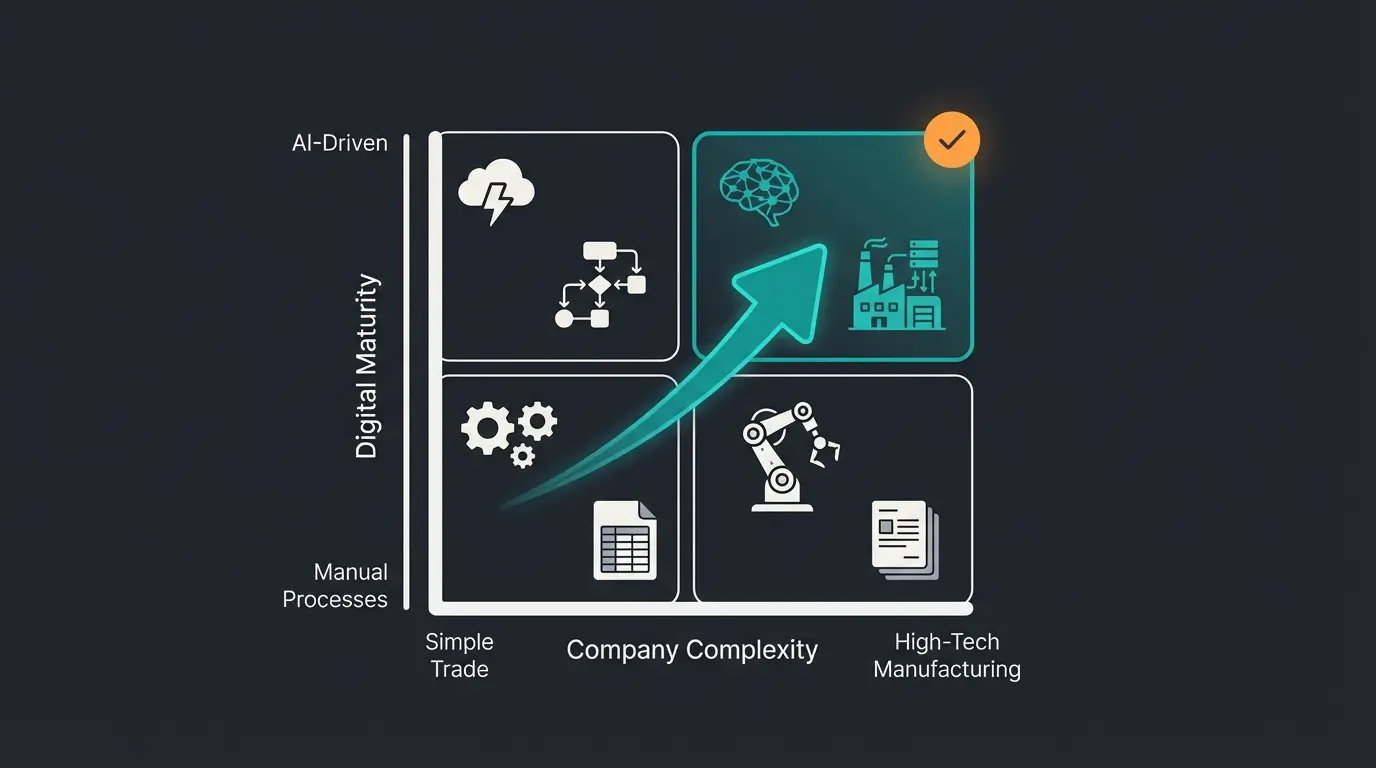

Market Overview: 3 Categories of ERP Systems

The market for ERP in Mittelstand companies is confusing. To facilitate selection, we categorize systems not alphabetically, but by complexity level and company DNA. It is crucial to honestly assess your position here.

Tier 1: The Cloud-Natives (Trade & E-Commerce Focus)

These systems are ideal for young mid-sized companies or pure trading businesses that want to scale quickly and have little complex manufacturing depth.

- Main Players: Weclapp, Xentral

- Target Group: 10–100 employees, focus on trade, e-commerce, simple services

- Strengths: Extremely fast implementation (often in weeks rather than months), modern API-first approaches (easy connection to shops like Shopify/Amazon), intuitive user interface (usability) requiring minimal training according to Weclapp and ERP-4-Business

- Weaknesses: Reach limits with complex manufacturing (multi-level BOMs, extended workbench) or deep corporate controlling

- Cost Framework: Transparent subscription model, often approx. €40–100 per user/month

Tier 2: The Industrial Backbone (Manufacturing Mittelstand)

This is the domain of classic ERP manufacturing Mittelstand. Here it's about manufacturing depth, CAD integration, and operational data collection (BDE).

- Main Players: proAlpha, abas ERP, Sage 100

- Target Group: 50–500+ employees, focus on discrete manufacturing, mechanical engineering, automotive suppliers

- Strengths: Deep production planning (APS, fine scheduling), understanding the "language" of the German Mittelstand (specifications, standards), strong integration of CAD/PLM data as noted by SoftwareSuggest

- Weaknesses: Often historically grown user interfaces, partly still on-premise heavy, updates can be complex

- Special Note: proAlpha positions itself strongly as a complete solution for the "Hidden Champion"

Tier 3: Platform Ecosystems (Scalability & AI Integration)

These systems offer a foundation on which partners build industry-specific solutions. They lead in integration with the Office world and AI capabilities. Understanding how Shopware ERP integration works can provide valuable insights into platform connectivity.

- Main Players: Microsoft Dynamics 365 Business Central, SAP Business One (and S/4HANA Public Cloud for upper mid-market)

- Target Group: 50–1,000+ employees, cross-industry, companies with international subsidiaries

- Microsoft Strengths: Seamless integration into Outlook/Teams. The "Copilot" (AI) is already deeply integrated here. Enormous customizability through partners according to DynamicsSmartz and ERP Software Blog

- SAP B1 Strengths: Strong financial accounting, globally standardized, very robust as highlighted by Aclaros

- Weaknesses: Implementation success depends heavily on the quality of the implementation partner (system house). Without customization, often not "out-of-the-box" suitable for German special requirements

| Feature | Tier 1 (Weclapp/Xentral) | Tier 2 (proAlpha/abas) | Tier 3 (Microsoft/SAP) |

|---|---|---|---|

| Focus | Trade, E-Commerce, Services | Manufacturing, Mechanical Engineering | Universal, Platform |

| Implementation Time | Fast (Weeks/Months) | Medium (6-12 Months) | Long (9-18+ Months) |

| AI Integration | Often native features, agile | Partly conservative, production focus | Very strong (Copilot, Joule) |

| Cost Structure | Low (OpEx) | Medium to High | High (Initial), Scalable |

| Best For | Startups, pure traders | Hidden Champions, manufacturers | High-growth SMEs, corporate subsidiaries |

The Game Changer: AI and Product Consultation

Here lies the biggest content gap in most comparisons. Most companies view ERP as purely backend. But in 2026, the ERP becomes the "brain" of sales. The conversational AI benefits for businesses are becoming increasingly clear as this transformation unfolds.

The Problem: The Uninformed Sales Team

In many mid-sized companies with technical products, a sales conversation proceeds as follows: The customer asks about a specific configuration. The sales rep says: "I need to check with the technical department." They write an email, wait two days, receive an answer, and contact the customer. In this time, the competitor may have already delivered.

Why? Because the knowledge is trapped in the ERP (bills of materials) or in the minds of engineers. This is where AI chatbots for e-commerce are revolutionizing customer interactions.

The Solution: The AI Consultation Layer

Modern ERP strategies rely on an AI layer on top of the ERP. This is the transition from data management to data activation.

- Generative AI (LLMs) in Action: Imagine your sales representative could ask the ERP in a chat: "Which gasket fits pump X-200 that we delivered to customer Müller in 2019, and is it in stock?"

- Technical Background: This doesn't require futuristic new software, but an ERP with clean APIs and an AI solution (like RAG – Retrieval Augmented Generation) that can access this data.

Understanding different types of chatbots helps organizations choose the right consultative AI approach for their specific ERP integration needs.

Use Cases for the Mittelstand

- Intelligent Inventory Queries: Not just "Is Part X available?" but "When will Part X likely be available again based on delivery times from the last 12 months?" (Predictive Analytics) as discussed by Bizowie and TechTarget.

- Automated Quote Generation: AI generates an initial quote draft from a customer request and ERP master data including technical descriptions according to Panorama Consulting.

- Complex Configuration Support: AI-driven product consultation enables sales teams to instantly verify compatibility for complex variant products.

Customer asks: Does Component A fit with Component B?

User opens 4 windows, checks BOM, manually compares specifications (Time: 10 minutes)

User asks chatbot the question, AI queries ERP database automatically

Answer: 'Yes, compatible. 47 units in stock.' (Time: 10 seconds)

Discover how AI-powered product consultation can unlock the hidden knowledge trapped in your ERP system and accelerate your sales cycles.

Start Your AI JourneySelection Criteria: The New 2026 Checklist

Forget the 50-page feature lists. Here are the criteria that truly determine future viability.

A. AI-Readiness (The New Standard)

- API-First Approach: Is there a documented REST API that can read and write all data fields? (Important for connecting AI tools)

- Data Structure: Does the system enforce structured data or does it allow "free-text chaos"? AI loves structure

- Cloud-Native: Is the system truly cloud-based (SaaS) or just a "hosted" old system? True AI features like Microsoft Copilot often only work in the genuine cloud version as noted by ERP Software Blog research

Companies looking to connect their e-commerce platforms should explore Shopware SAP integration strategies to maximize AI capabilities across systems.

B. Industry Fit vs. Platform Flexibility

The Key Question: Do I take a niche solution (e.g., industry software for furniture construction) or a large platform (Microsoft/SAP)?

Trend: The trend moves toward platform + industry app. Niche providers struggle to keep up with AI development. It is often safer to take a large platform (Microsoft) and purchase an industry add-on. The concept of AI employees evolving in the workplace supports this platform-centric approach.

C. Costs (Total Cost of Ownership)

The question "What does an ERP system cost?" can be roughly tiered for the Mittelstand, but beware of hidden service costs.

- Rule of Thumb for Implementation: The software license often accounts for only 20–30% of costs in the first year. The rest are services (consulting, data migration, training) according to Glasholz and ITransition.

Budget Indication for Mittelstand (100 Users)

- Tier 1 (Weclapp/Xentral): Implementation approx. €20,000 – €50,000, ongoing approx. €5,000/month

- Tier 2/3 (Dynamics/SAP/proAlpha): Implementation approx. €100,000 – €500,000+, ongoing significantly variable depending on modules as per MAC-ITS analysis

Funding Opportunities

The popular program "Digital Jetzt" has expired (end of 2023). Currently relevant is the KfW ERP Digitization and Innovation Credit (No. 380), which offers low-interest loans and partial repayment grants for digitalization projects according to KfW. Additionally, check state programs like the "Digitalbonus Bayern" as noted on Bayern.de and STBV Bremen.

Implementation Guide: Avoiding the Data Swamp

Studies show that nearly one-third of all ERP projects exceed budget or fail according to BCG research. The main reason in 2026? Poor data quality that prevents the use of modern features.

Step 1: The Data Inventory (Before Selection!)

Before you call a vendor, examine your data:

- How many duplicates do you have in the customer master?

- Are product characteristics (color, size, material) in separate fields or hidden in item text?

- Data Cleansing Checklist: Use deduplication tools before you migrate. AI can later only advise as well as the data foundation allows (Garbage In, Garbage Out) as emphasized by Numerous.ai

Step 2: The Minimum Viable ERP Approach

Don't try to perfect everything on Day 1 (Big Bang). Start with core processes (Finance, Purchasing, Sales). Connect complex additional requirements (e.g., fully automated route planning) only in Phase 2. This massively reduces the risk of failure.

Step 3: Change Management Is Not Just a Buzzword

Your employees must feed the system. If the input screens are too complicated, they will use workarounds (Excel).

Successful implementations often involve AI Employee solutions like Kira that demonstrate how modern interfaces drive user adoption and productivity gains.

The AI-Readiness Checklist for Mid-Market Companies

Before embarking on your ERP journey, assess your organization's readiness for AI-enhanced systems:

- Are your master data (articles, customers) cleaned and deduplicated?

- Are product information stored in structured form (attributes instead of free text)?

- Are your processes documented (target process defined)?

- Have you defined a cloud strategy (acceptance of SaaS)?

- Is budget for change management and training planned (approx. 10-15% of project budget)?

Organizations looking at success stories can learn from AI Employee Flora, which demonstrates how structured data enables powerful AI consultation capabilities.

Conclusion: ERP as a Competitive Advantage

In summary: The search for ERP Mittelstand software has transformed. It's no longer about managing scarcity, but about activating knowledge.

- Administration Was Yesterday: Your ERP must become the engine for your sales and product consultation.

- AI Is Mandatory: Not as a gimmick, but to navigate through the data jungle and relieve skilled workers.

- Cleanliness Before Speed: Invest time in your data structure before buying software.

The future belongs to companies that use their data, not just store it.

If you face this decision, view your ERP investment as building a "digital brain." The software provides the synapses (connections), but your data quality determines your company's IQ. Use the available KfW funding credits and choose a partner who not only installs software but understands your processes.

Frequently Asked Questions About ERP for Mittelstand

Mittelstand ERP systems like SAP Business One or Microsoft Dynamics 365 Business Central are specifically designed for companies with 50-500 employees. Unlike enterprise solutions like SAP S/4HANA, they offer faster implementation (months vs. years), lower total cost of ownership, more intuitive interfaces requiring less training, and pre-configured industry templates. However, they still provide robust manufacturing, financial, and supply chain capabilities suited for Hidden Champions and complex product manufacturers.

For mid-sized companies with approximately 100 users, budget indications vary by tier: Tier 1 cloud-native solutions (Weclapp/Xentral) require €20,000-50,000 implementation plus €5,000/month ongoing. Tier 2/3 industrial and platform solutions (Dynamics/SAP/proAlpha) require €100,000-500,000+ implementation with variable ongoing costs depending on modules. Remember that software licenses typically represent only 20-30% of first-year costs – the majority goes to consulting, data migration, and training.

AI-readiness refers to an ERP system's capability to support artificial intelligence integration. Key factors include: API-first architecture with documented REST APIs for all data fields, enforced structured data (attributes vs. free text), true cloud-native SaaS deployment (not just hosted legacy software), and clean data foundations. Systems with high AI-readiness can integrate tools like Microsoft Copilot or connect to RAG (Retrieval Augmented Generation) solutions for intelligent product consultation.

The trend in 2026 favors platform + industry app combinations. While niche solutions offer deep domain expertise, they struggle to keep pace with AI development from major vendors. A safer approach is selecting a large platform (Microsoft Dynamics, SAP) and adding industry-specific add-ons. This ensures you benefit from continuous AI innovation while maintaining industry-specific functionality.

The "Digital Jetzt" program ended in 2023. Currently, the KfW ERP Digitization and Innovation Credit (Nr. 380) offers low-interest loans and partial repayment grants for digitalization projects. Additionally, check regional programs like "Digitalbonus Bayern" for state-specific incentives. These programs can significantly reduce the financial burden of ERP modernization and AI integration projects.

Join forward-thinking Mittelstand companies using AI-powered product consultation to unlock trapped ERP knowledge and accelerate sales cycles by 10x.

Get Started Today