Introduction: The ERP Selection Dilemma

Selecting ERP software is one of the highest-risk decisions a CEO or IT director can make. It's essentially performing 'open-heart surgery' on your company. If you search for 'best ERP software' today, you'll be flooded with comparison portals offering static lists. Capterra, OMR, and similar platforms list hundreds of tools rated with stars that often say more about the vendor's marketing budget than about suitability for your specific processes.

The problem is clear: A list cannot know whether you need batch traceability, how your warehouse logistics are structured, or whether you require a DATEV interface with cost center accounting. This is where modern approaches like AI product consultation come into play, offering personalized recommendations based on your actual business needs.

This article is different. We're not delivering just another ERP software comparison of features—we're providing a strategic framework. We analyze the market for 2025/2026, uncover hidden costs, and demonstrate why the future of ERP selection lies not in static lists, but in AI-powered consultation.

What is ERP Software? A Clear Definition

Before diving into comparisons, we need to draw a clear line. Many small businesses use tools like Lexware Office or SevDesk and believe they have an ERP system. This is often a misconception.

The Definition of ERP

Enterprise Resource Planning (ERP) refers to the business task of planning and controlling resources (capital, personnel, equipment, materials) in a timely and needs-based manner. ERP software is the digital representation of these processes. It connects all departments—from purchasing through production and sales to accounting—in a single database. According to kmu-erp-experten.org, this integration is what distinguishes true ERP from simpler business tools.

ERP vs. Accounting Software: The Critical Difference

Understanding this distinction is crucial for your selection process. Many businesses conflate these two categories, leading to poor software choices that don't scale with their operations.

| Feature | Accounting Software (e.g., Lexware, SevDesk) | ERP Software (e.g., Haufe X360, SAP B1, weclapp) |

|---|---|---|

| Focus | Retrospective documentation (finances, taxes) | Forward-looking planning & control (goods flow, production) |

| Data Flow | Isolated (silos), often manual import | Integrated (real-time data flow between warehouse & sales) |

| Complexity | Low, 'plug & play' | High, often requires implementation & customization |

| Target Group | Freelancers, micro-businesses | Growing SMEs, mid-market, enterprises |

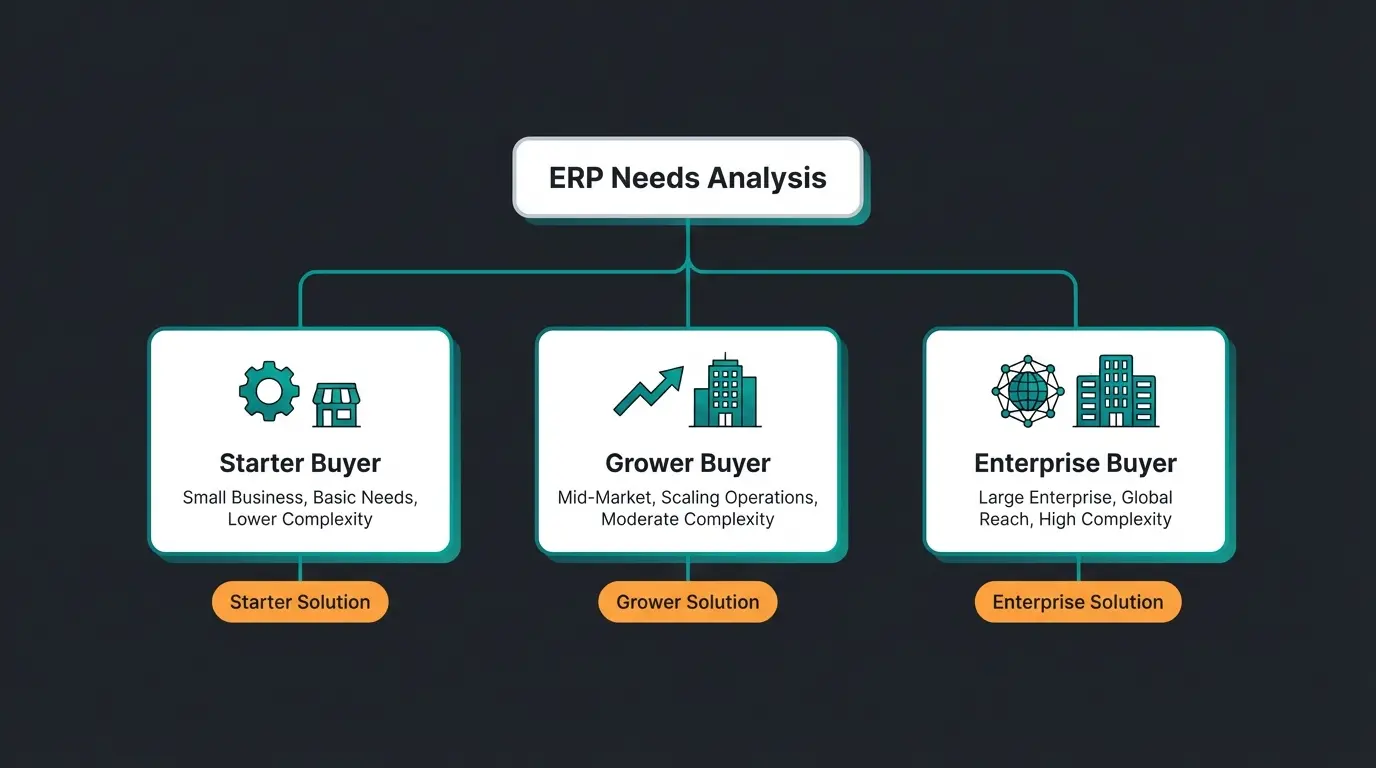

The 3 Categories of ERP Buyers: Where Do You Stand?

A common mistake is comparing apples to oranges. An ERP software comparison only makes sense within the same category. Based on company size and complexity, three buyer types can be identified. This segmentation approach helps avoid the 'analysis paralysis' problem that plagues most businesses during their ERP search.

Type A: The Starter (Small & Agile)

- Profile: 1-20 employees, services or simple retail

- Needs: Standard processes, quick implementation (few days), cloud-only

- Focus: Usability, price, mobile app

- Examples: weclapp (Cloud), Xentral (Starter), Lexware

- Cost Range: €30-60 per user/month, minimal implementation costs

Type B: The Grower (Mid-Market & Specialists)

- Profile: 20-250 employees, complex inventory, production or project business

- Needs: Customization, deep integrations, industry-specific functions

- Focus: Scalability, automation, compliance (GoBD in Germany)

- Examples: Haufe X360, MyFactory, Odoo, Sage 100

- Cost Range: €60-150 per user/month + €10,000 to €100,000 implementation

Type C: The Enterprise (Complex & Global)

- Profile: 250+ employees, international locations, corporations

- Needs: Multi-company, multi-currency, extensive custom development

- Focus: Governance, security, complete ecosystem

- Examples: SAP S/4HANA, Microsoft Dynamics 365, Oracle NetSuite

- Cost Range: Projects often six to seven figures

1-20 employees = Starter, 20-250 = Grower, 250+ = Enterprise

Simple processes = Type A, Production/Project = Type B, Global/Multi-entity = Type C

Under €5K implementation = Starter, €10-100K = Grower, €100K+ = Enterprise

Select ERP systems designed for your specific category

Top ERP Systems in Germany 2025/2026: Detailed Analysis

Instead of an endless list, we focus on the most relevant players for the German mid-market (SMEs) that dominate search results and market share analyses. This approach aligns with how AI-powered sales consultants work—focusing on the 20% of options that match 80% of use cases.

1. Haufe X360 (formerly lexbizz)

Category: Type B (Grower) | Deployment: Cloud (SaaS)

Haufe X360 has established itself as a strong solution for the mid-market. Technologically, it's based on the US system Acumatica but has been fully localized for the German-speaking market (DACH), according to Haufe X360 and Wikipedia.

Strengths:

- 360-Degree Approach: Very strong ecosystem connecting classic ERP with e-commerce and financial accounting

- Flexibility: Modular structure—you pay for what you use (production, e-commerce, or services)

- Partnership: Through cooperation with Shipcloud, it offers enterprise-level logistics features for SMEs, as noted by Shipcloud

Pricing Model: Starts at approximately €49 (services) up to €185+ (production/service) per user/month. There are minimum booking amounts (often around €449/month).

Consultant's Take: Ideal for companies outgrowing simple solutions and seeking a true cloud platform that scales with them. However, implementation requires certified partners.

2. weclapp

Category: Type A to B | Deployment: Cloud (SaaS)

Weclapp is one of the most popular providers of ERP software for small businesses and e-commerce retailers in Germany. It advertises 'Made in Germany' and high user-friendliness, as highlighted by weclapp and industry reviews on Zeeg.

Strengths:

- Usability: Modern interface requiring minimal training

- E-Commerce: Excellent connectivity to shops (Shopify, Shopware) and marketplaces (Amazon, eBay)

- All-in-One: CRM and project management are deeply integrated

Pricing Model: Transparent subscription model. 'Cloud ERP Services' from approximately €39-69, 'Cloud ERP Retail' slightly higher. Discounts for 1-2 year contracts, according to Navaya.

Consultant's Take: The 'no-brainer' for e-commerce startups and agencies. However, for complex manufacturing depths, it reaches its limits sooner than Haufe X360 or SAP. This is where proper Shopware ERP integration becomes essential.

3. SAP Business One

Category: Type B (upper mid-market) | Deployment: Hybrid (Cloud & On-Premise)

Often misunderstood as 'small SAP'—it's an independent solution for SMEs, not to be confused with S/4HANA. Detailed information is available from SMC-IT and Business One Beratung.

Strengths:

- Functional Depth: Extremely powerful in warehouse management, production, and reporting

- Internationality: If you plan to establish subsidiaries abroad, SAP B1 is unmatched (multi-currency, local tax laws)

- HANA Database: Enables real-time analytics of large data volumes

Pricing Model: Higher entry threshold. Licenses often cost €2,700 (Professional) to €1,400 (Limited) one-time per user (on-premise) or approximately €91/month in the cloud. High implementation costs apply, as detailed by Business One Consultancy.

Consultant's Take: The gold standard for small industrial companies with growth ambitions. But caution: It's complex and requires experienced consultants. Not for 'quick and easy implementation.'

4. MyFactory

Category: Type B | Deployment: Cloud / Private Cloud

MyFactory is a veteran in the cloud ERP market, offering high flexibility since it can also be hosted on your own servers (private cloud), according to MyFactory and MKP-IT.

Strengths:

- Web-Based: Was one of the first systems running completely in the browser

- Customizability: Highly adaptable to specific industry processes

- PPS: Strong module for production planning and control

Pricing Model: Modular approach. Business Manager, ERP, CRM, PPS can be combined. Prices often start at approximately €99 subscription, scaling with modules, as noted by ERP-4-Business.

Consultant's Take: A solid choice for manufacturing SMEs wanting to retain data sovereignty (private cloud option) while seeking the benefits of a web interface.

5. Odoo

Category: Type A to B (Open Source) | Deployment: Cloud / On-Premise

Odoo is the 'disruptor' in the market. With an open-source core and thousands of apps, it's extremely modular, according to Odoo and market analyses.

Strengths:

- Modularity: Start with CRM and simply add warehouse, accounting, or website

- Price: Aggressive pricing (often free for the first app, then flat rates per user)

- Community: Huge ecosystem of developers

Weakness/Risk: GoBD compliance in Germany was long a concern. Odoo is now certified (IDW PS 880), but responsibility lies with the user to configure the system correctly (posting finalization, etc.), as explained by Odoo compliance documentation and Much Consulting.

Consultant's Take: Perfect for tech-savvy companies wanting everything in one system (including website builder). However, you absolutely need a German Odoo partner to set up accounting in a legally compliant manner.

A static list can't know your business workflows. Discover how AI-driven consultation helps you find the perfect ERP match based on your specific requirements.

Get Your Free AI ConsultationERP Software Costs: The Truth Behind the Price Tag

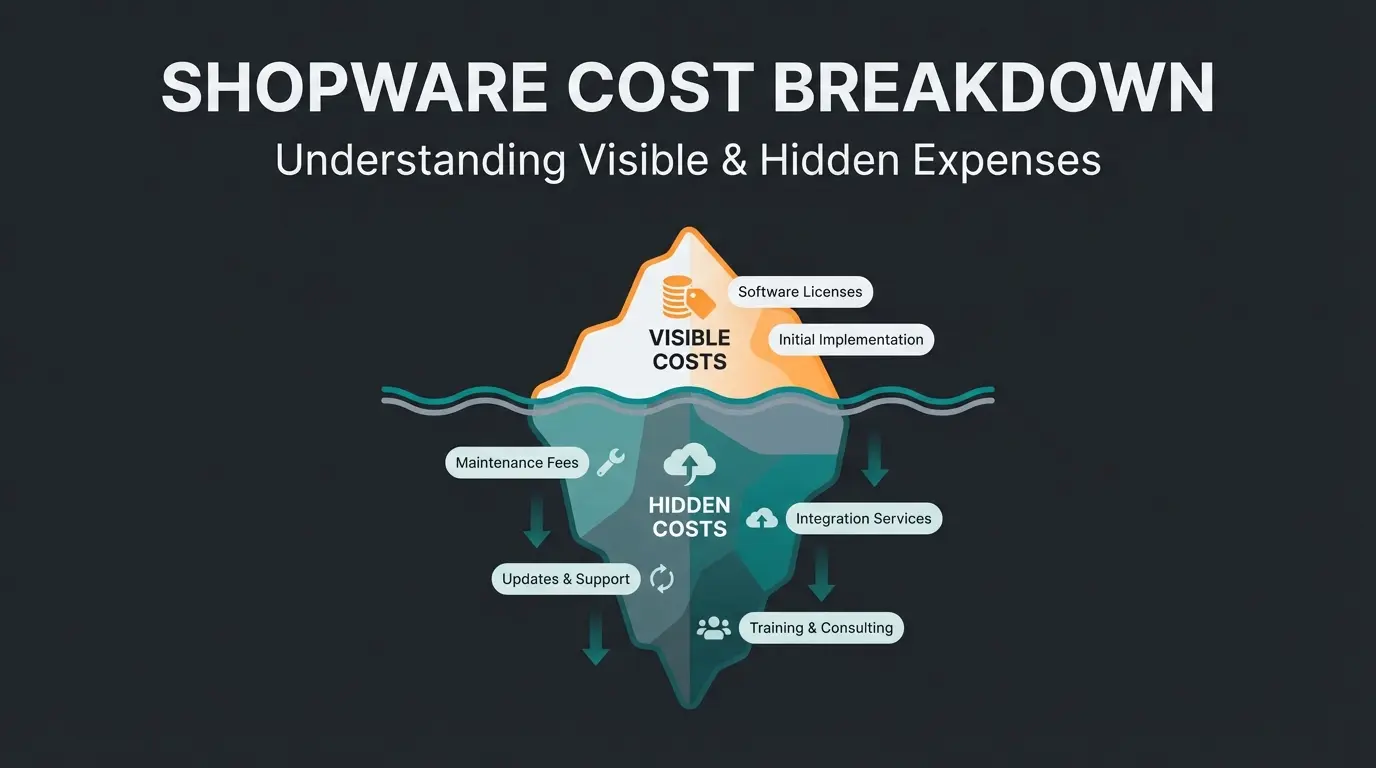

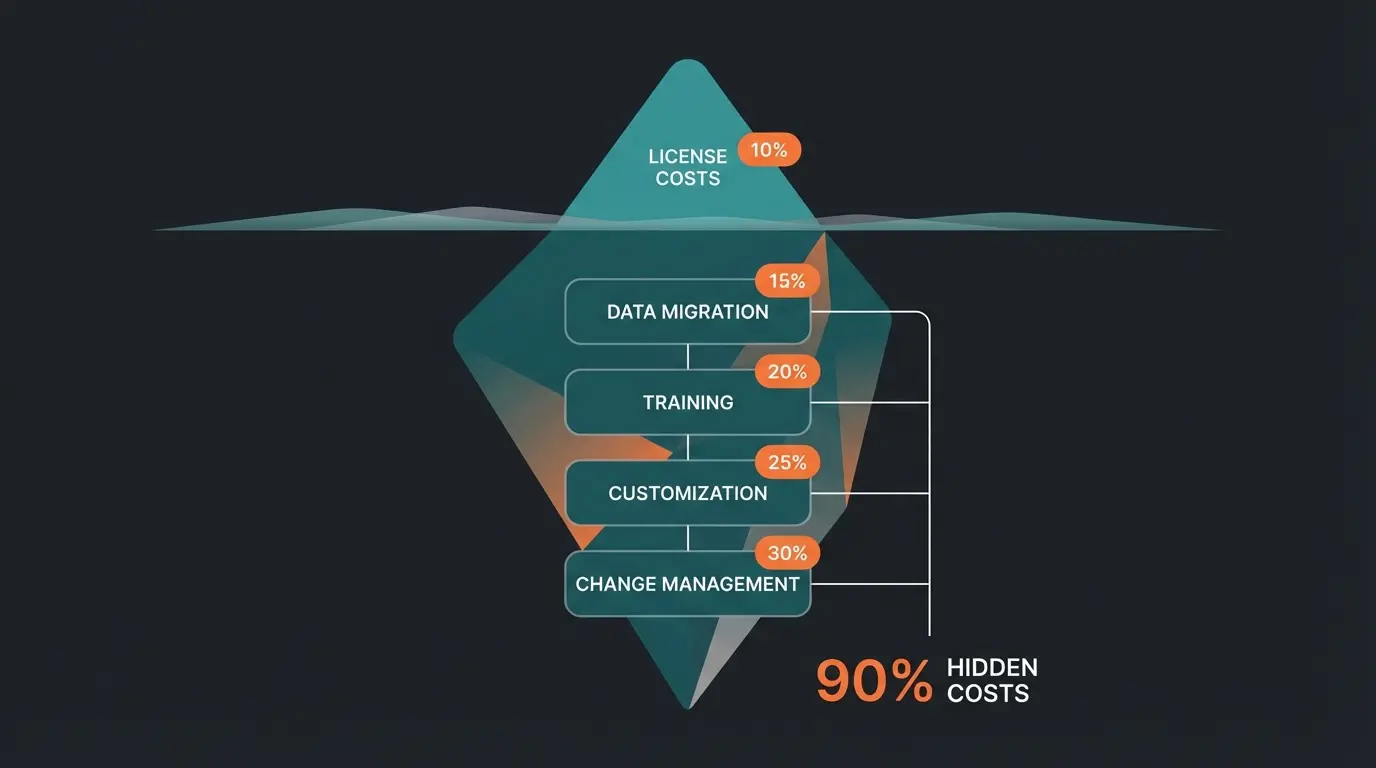

When searching for ERP software costs, you'll mostly find license prices. But this is dangerous. In the industry, we speak of the 'iceberg model'—what you see is only a fraction of what you pay.

The Visible Part: License Costs

- Cloud (SaaS): Monthly rental. Range: €30 to €200 per user/month

- On-Premise: One-time purchase. Range: €1,500 to €4,000 per user + annual maintenance (approximately 18-22% of license value), according to Glasholz

The Invisible Part: Implementation & Service

This is where budgets fail. The rule of thumb for the ratio of software costs to service costs is often 1:1 to 1:3, according to research by Panorama Consulting and ERP Software Blog. This means: If you purchase licenses for €20,000, expect €20,000 to €60,000 for implementation.

What are you paying for?

- Process Analysis: The consultant must understand how you work

- Data Migration: Customer data from Excel or legacy systems must be cleaned and imported

- Customization: Adjustment of screens, workflows, and forms (invoice design)

- Training: Employees must learn to operate the system

- Change Management: The often underestimated resistance from staff must be managed, as noted by Hamburger Software

What most vendors advertise—only the tip of the iceberg

Data migration, customization, training, and change management

For every €1 in licenses, expect up to €3 in services

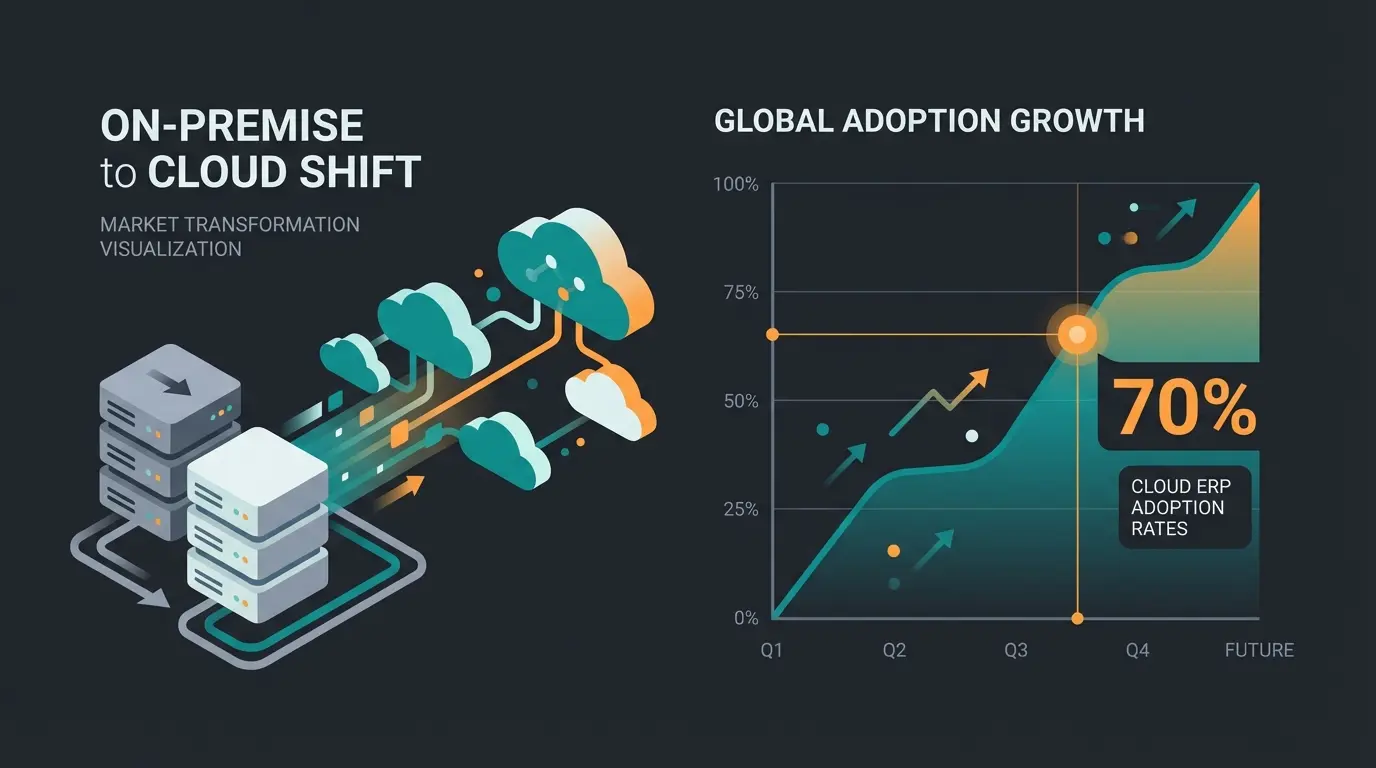

Cloud vs. On-Premise: TCO Comparison

Studies show that cloud solutions are initially cheaper (OpEx), but cost curves can intersect after approximately 5-7 years. Nevertheless, cloud dominates because the 'hidden' costs for own servers, IT personnel, backups, and security with on-premise are often forgotten, according to analysis by Business.digital and Scopevisio.

Selection Strategy: Why Comparison Lists Fail

Most companies proceed like this:

- Google search 'Best ERP Software'

- Read 'Top 10' lists on Capterra

- Invite 3 vendors for demos

- Purchase based on the best sales pitch

The result: 'Analysis paralysis' or a wrong decision. A salesperson will always tell you their system meets your requirements—'standard or with a small customization.' This is where Consultative AI offers a fundamentally different approach.

The New Way: AI-Powered Consultation

The market is too complex for manual comparisons. This is where AI (Artificial Intelligence) comes into play—not as a feature in the ERP, but as a tool for selecting the ERP. Just as digital product consultants help customers find the right products, AI can help businesses find the right software.

Instead of using static filters ('Industry: Retail'), modern matching algorithms analyze your process descriptions:

- Input: 'We manufacture custom machines, need deposit invoices, and have a consignment warehouse.'

- Analysis: The AI understands the dependencies (manufacturing → financial accounting → warehouse).

- Output: A shortlist of systems that master exactly this combination, without you reading 50 data sheets.

Advantage: The AI is unbiased. It evaluates functionality, not marketing budget. This approach mirrors how revenue-generating product consultants work in e-commerce—matching needs to solutions without sales bias.

Trends 2025/2026: What Your New ERP Must Handle

If you invest today, the system must still be competitive in 2030. Pay attention to these trends, which are shaping the future of enterprise software and Conversational Commerce alike.

1. The E-Invoicing Mandate (Germany)

From January 1, 2025, receiving and processing e-invoices (structured data sets like XRechnung or ZUGFeRD) in B2B transactions is mandatory. Simple PDFs are no longer sufficient, according to IHK Germany and the German Federal Ministry of Finance.

2. Agentic AI & Autonomous Workflows

We're moving from 'automation' to 'autonomy.' By 2026, AI agents in ERP systems will independently complete tasks, according to research from CrossML and CloudKeeper.

Example: An AI agent notices a supplier has delivery problems, searches for alternative suppliers, checks prices, and suggests an order to the buyer—or executes it independently for small parts.

Trend: Gartner predicts that by 2026, 40% of enterprise apps will have such AI agents integrated. This is similar to how AI customer service is transforming support operations—from reactive to proactive.

3. Cloud Dominance

The cloud ERP market share is expected to rise to 70% by 2025, according to Cargoson. On-premise becomes a niche for highly sensitive specialized areas. The reason isn't just flexibility, but security: Hyperscalers (AWS, Azure) offer security standards that a mid-sized server room can never achieve.

Projected share of new ERP implementations by 2025

Enterprise apps with AI agents by 2026 (Gartner)

B2B e-invoicing becomes mandatory in Germany

Comparison: Generalist vs. Specialist ERP Systems

One key decision often overlooked in standard comparisons is whether to choose an all-in-one suite or an industry specialist. This mirrors the decision many e-commerce businesses face when implementing AI Employee E-Commerce solutions—generic versus specialized.

| Criteria | Generalist ERP (All-in-One) | Specialist ERP (Industry-Specific) |

|---|---|---|

| Examples | SAP, Microsoft Dynamics, Odoo | Construction ERP, Manufacturing ERP, Retail ERP |

| Flexibility | High—covers all basic needs | Moderate—deep in specific area |

| Implementation Time | Longer—more customization needed | Shorter—pre-configured for industry |

| Cost | Higher upfront, economies of scale | Lower entry, potential limitations later |

| Best For | Companies with diverse operations | Companies with specific industry workflows |

Real-World Application: Learning from Success Stories

Understanding how businesses successfully implement technology solutions provides valuable insights for ERP selection. Companies that have implemented AI product consultation demonstrate the importance of matching tools to specific business processes rather than following generic recommendations.

Similarly, businesses using AI Chat solutions show that technology adoption succeeds when it addresses specific pain points. The same principle applies to ERP selection—your chosen system should solve your unique challenges, not just check feature boxes from a comparison list.

The evolution toward AI product consultation complete solutions in e-commerce mirrors the shift happening in ERP selection: from static comparisons to intelligent matching based on actual business requirements.

Conclusion: Don't Make Decisions from Your Gut

The search for the best ERP software doesn't exist. There is only the most suitable software for your business model.

- Don't rely on static best-of lists

- Don't underestimate implementation costs (factor 2-3 of license costs)

- Pay attention to future-readiness (e-invoicing, AI-readiness)

Our tip: Use technology to find technology. A static comparison cannot map your individual workflows. Start with a clean requirements analysis and get neutral advice—whether through experts or intelligent matching tools.

FAQ: Common Questions About ERP Software

For small businesses (Type A), costs typically range between €30 and €70 per user per month for cloud solutions. Implementation costs are often low here (under €5,000) since standards are used. However, remember the 1:1 to 1:3 ratio—for every euro in licenses, budget at least the same for implementation services.

Yes, generally more secure than local servers in SMEs. Providers like Haufe or weclapp use certified data centers in Germany (ISO 27001) that offer geo-redundancy and professional protection against cyber attacks. Hyperscalers like AWS and Azure provide security standards that most mid-sized server rooms cannot match.

The obligation to receive e-invoices in B2B transactions applies from January 1, 2025, in Germany. For sending, there are transition periods until 2027/2028 depending on revenue, according to information from Sage and the German Federal Ministry of Finance.

For pure e-commerce, weclapp and Xentral are leading choices. For wholesale with complex warehouse logistics, Haufe X360 or MyFactory are often better suited. The key is matching the system to your specific fulfillment and inventory management requirements.

For Type A (Starter) businesses, implementation can take days to weeks. Type B (Grower) implementations typically require 3-6 months. Enterprise implementations often take 12-24 months or longer. The timeline depends heavily on data migration complexity and customization requirements.

Stop reading endless comparison lists. Let AI analyze your specific workflows and recommend the ERP systems that actually fit your business. No sales bias, just intelligent matching.

Start Your Free Assessment