Introduction: The Default Isn't Always the Best Solution

When you open a Shopify store in Germany, Shopify Payments is usually the first recommendation the system gives you. It's convenient, pre-installed, and promises to unite all important Shopify payment methods under one roof. But for German merchants, the situation is more complex than in the USA.

The German e-commerce market is peculiar. We love invoice purchases, are skeptical of credit cards, and have strict data protection requirements. Add to this a fee structure that appears transparent at first glance but reveals pitfalls upon closer inspection. Understanding Shopify costs in 2026 is essential for making informed decisions about your payment setup.

In this comprehensive guide for 2025/2026, we analyze Shopify Payments not just technically, but strategically. We reveal why the pure transaction fee isn't your biggest cost factor and why a Shopify payment setup that works technically can still fail economically if you ignore the topic of returns.

We take a look at the details that agencies often conceal: What happens when Shopify freezes your money? Why is the end of Giropay relevant? And how can artificial intelligence (AI) reduce your payment costs more effectively than any rate change?

What Is Shopify Payments? The Fundamentals Explained

Before we talk about money, we need to understand the technology. Shopify Payments is essentially a white-label solution from the payment service provider Stripe. This means: Shopify uses Stripe's technology, deeply integrates it into its own dashboard, and acts as your contractual partner.

For you as a merchant, this means: You don't need a separate contract with a bank or credit card acquirer. You flip the switch, and theoretically, the money flows. When comparing platforms, the Shopware vs Shopify comparison shows how Shopify's integrated payment solution provides a significant advantage over competitors.

Which Payment Methods Are Included in Germany?

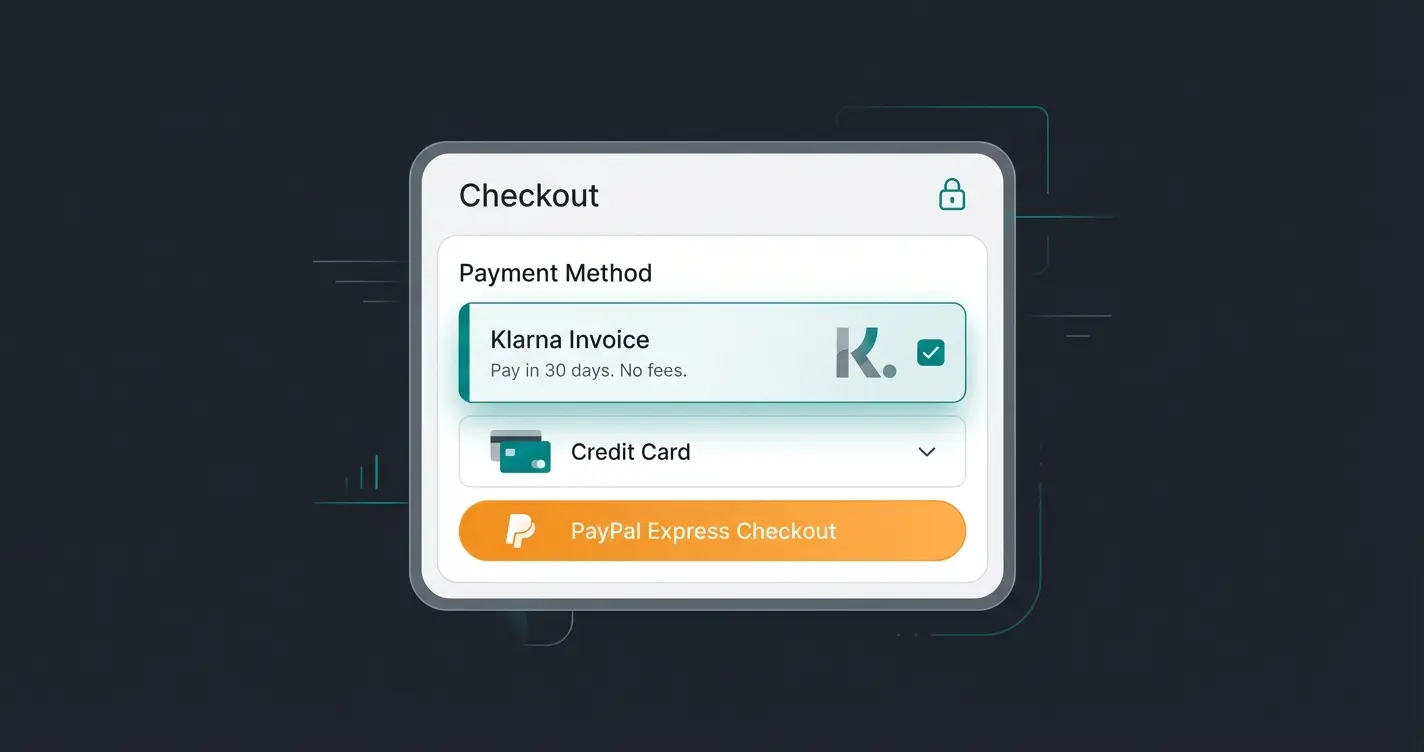

Acceptance of the right payment methods is the most important lever for conversion rate in Germany. Shopify Payments covers a large portion of these:

- Credit Cards: Visa, Mastercard, American Express, Maestro

- Digital Wallets: Apple Pay, Google Pay, Shop Pay

- Local Heroes: Klarna (invoice payment—extremely important in Germany), instant bank transfer, installment payments

- Bancontact: Essential if you sell to Belgium

- iDEAL: Mandatory for sales to the Netherlands

- EPS: Important for Austria

The Difference from Third-Party Providers

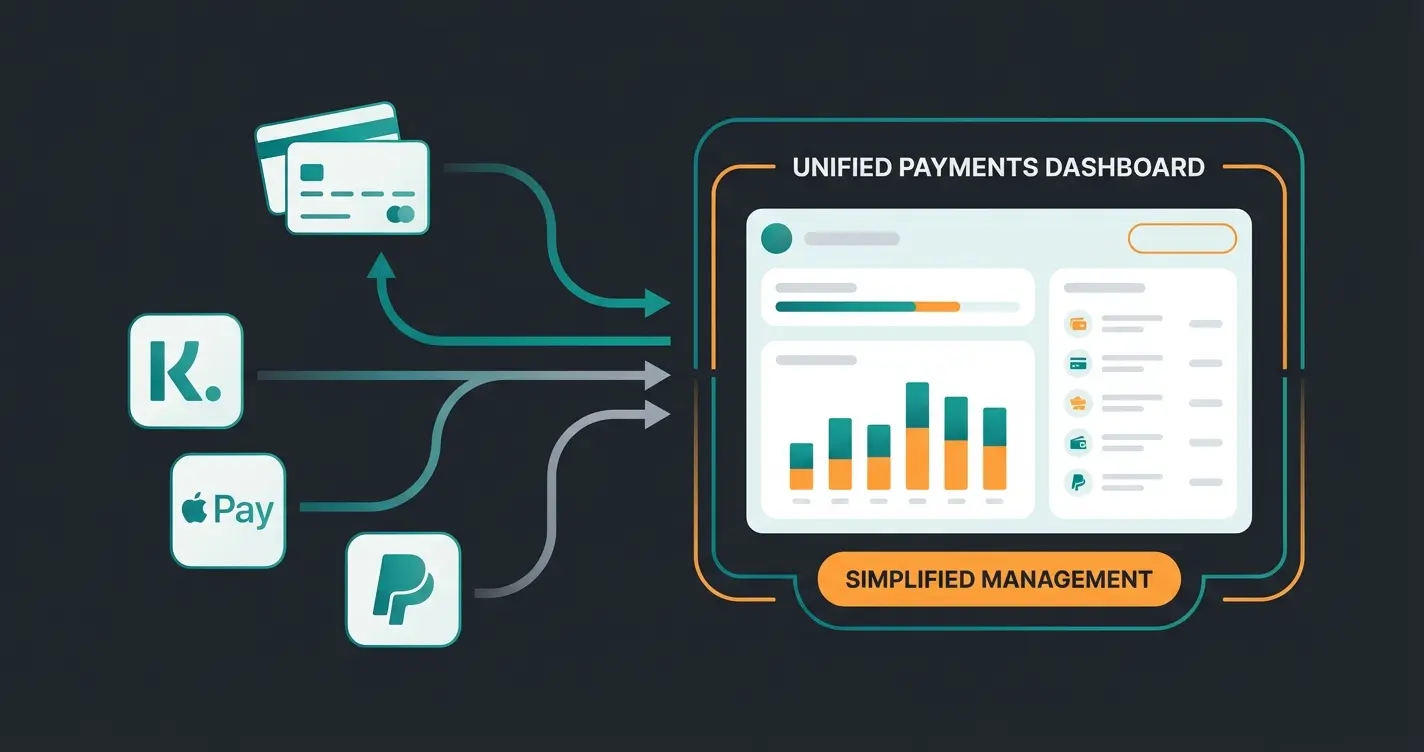

Without Shopify Payments, you would need to sign contracts with providers like Mollie, Authorize.net, or Adyen for each of these payment methods (or bundles thereof). Shopify Payments bundles everything into a single payout and a single dashboard. For merchants evaluating their options, understanding Shopify alternatives in Germany helps put this convenience into perspective.

Cost Analysis: Fees & The Penalty Fee Structure

The cost structure of Shopify Payment is the most frequent topic of discussion. Many merchants only look at the credit card fee but overlook the overall calculation.

Transaction Fees Overview (As of 2025)

The fees depend heavily on your chosen Shopify plan. Here's an overview of typical conditions for Germany (prices plus VAT):

| Fee Type | Basic Plan (~€36/month) | Shopify Plan (~€105/month) | Advanced Plan (~€384/month) |

|---|---|---|---|

| Credit Card (EU/Standard) | ~2.1% + €0.30 | ~1.8% + €0.30 | ~1.6% + €0.30 |

| Credit Card (Amex/International) | ~2.9% + €0.30 | ~2.7% + €0.30 | ~2.5% + €0.30 |

| Klarna Invoice | ~2.99% + €0.35 | ~2.99% + €0.35 | ~2.99% + €0.35 |

| Instant Bank Transfer | ~1.4% + €0.25 | ~1.4% + €0.25 | ~1.4% + €0.25 |

| Bancontact (Belgium) | ~1.4% + €0.25 | ~1.4% + €0.25 | ~1.4% + €0.25 |

Note: The exact percentages may vary slightly depending on current Shopify promotions and specific contracts, but the trend remains: Higher fixed-cost plan = lower variable costs, as confirmed by Coding9 and Latori.

The Penalty Fee for External Gateways

This is the most important point that many beginners overlook. If you DO NOT use Shopify Payments, Shopify charges an additional transaction fee on all revenue processed through external providers (like PayPal when used alone, or Mollie).

- Basic Plan: + 2.0% penalty fee

- Shopify Plan: + 1.0% penalty fee

- Advanced Plan: + 0.5% penalty fee

These penalty fees are documented by Spocket and Eesel.ai.

Hidden Costs: Currency Conversion & Chargebacks

Chargebacks (Reversals): When a customer disputes a credit card payment with their bank, it costs you €15.00 processing fee in Germany—plus the loss of the goods and revenue, as documented by Shopify Help.

Currency Conversion: Selling to the USA or Switzerland and getting paid out in Euros? Shopify charges a currency conversion fee (approx. 1.5% - 2%) for this, unless you use Shopify Markets Pro according to Shopify documentation.

Per disputed transaction in Germany

For using external gateways on Basic plan

When selling internationally without Markets Pro

Standard processing for German bank accounts

Pros & Cons: The Unvarnished Truth

As an experienced merchant, you know: Every tool has disadvantages. Here's the honest comparison based on community experience and current data.

The Advantages of Shopify Payments

- Integrated Conversion: Customers stay in checkout. No redirection to external pages (except for PayPal/Klarna App), which reduces abandonment rate.

- Klarna Included: Essential for Germany. The integration is seamless, without a separate Klarna contract.

- Single Dashboard: Refunds can be clicked directly in the order. No need to log into the bank.

- Cost Savings: Elimination of the external transaction fees mentioned above.

- Shop Pay: Shopify's 'Amazon killer.' Customers who have ever purchased anywhere on Shopify can pay via SMS code in seconds. This enormously boosts mobile conversion.

The Disadvantages & Risks

1. Frozen Funds: This is the biggest risk. Since Shopify (via Stripe) acts as an aggregator, the security algorithms react extremely sensitively. Scenario: Your shop goes viral, revenue jumps from €100 to €10,000 a day. Reaction: Shopify freezes payouts to verify you're not a fraudster. This can take 3-14 days and endanger your liquidity. This is documented in Shopify Community discussions and Shopify Help resources.

2. Strict Product Policies: Shopify Payments prohibits many categories that would actually be legal in Germany. These often include certain CBD products, dietary supplements with 'healing claims,' e-cigarettes, or services in the adult entertainment sector, as outlined in Shopify's prohibited business list. Anyone who violates the terms of service will be banned for life.

3. No Fee Refunds on Returns: When you refund a customer €100, you do NOT get the original transaction fee (e.g., €2.40) back according to Shopify refund policies. This adds up massively with high return rates. When issues arise, knowing how to reach Shopify customer service becomes crucial.

Setup & Configuration: The German Requirements

The setup is technically simple but bureaucratically strict. Shopify compares your data with German registration databases.

Step-by-Step Setup Guide

Go to Admin Area > Settings > Payments in your Shopify dashboard

Click 'Set up account' under Shopify Payments

Choose correctly between GmbH, UG, Sole Proprietorship (Einzelunternehmen), or GbR. For GbR, all partners may need verification

Have your commercial register number (HRA/HRB) and VAT ID ready. The name must match EXACTLY with the commercial register

Must be an EU checking account that accepts Euros (SEPA-capable). Savings accounts or virtual accounts from some neobanks may cause issues

The verification requirements are detailed in Shopify's documentation for German merchants and business verification help articles.

The Local Payment Methods Activation Trick

After activation, you often need to manually enable local methods. Go into the Shopify Payments configuration and verify that Klarna and Sofort (instant bank transfer) are checked. These only appear in checkout when the customer comes from the corresponding country (e.g., Germany, Austria) and the currency is Euros, as explained in Shopify's local payment methods guide.

Strategic Optimization: Your Competitive Edge

Here we leave the standard path. Most merchants activate Shopify Payments and stop there. To be profitable in 2025, you need to think further. A strong Shopify SEO strategy combined with optimized payments creates the foundation for sustainable growth.

The Trust Stack for Germany

Don't rely only on Shopify Payments. German customers are creatures of habit.

The Ideal Combination: Shopify Payments (for credit card, Apple Pay, Klarna) PLUS PayPal Express PLUS (optionally) Amazon Pay.

Why? Many customers have PayPal balances or trust Amazon blindly. If you leave out these options to save fees, you often lose more in conversion than you save in fees. Pro Tip: Configure PayPal so it doesn't 'spam' the checkout. Use the Express buttons sensibly. When comparing WooCommerce vs Shopify, Shopify's integrated payment flexibility is a significant advantage.

The Refund Economy: Why Payment Method Is Only Half the Battle

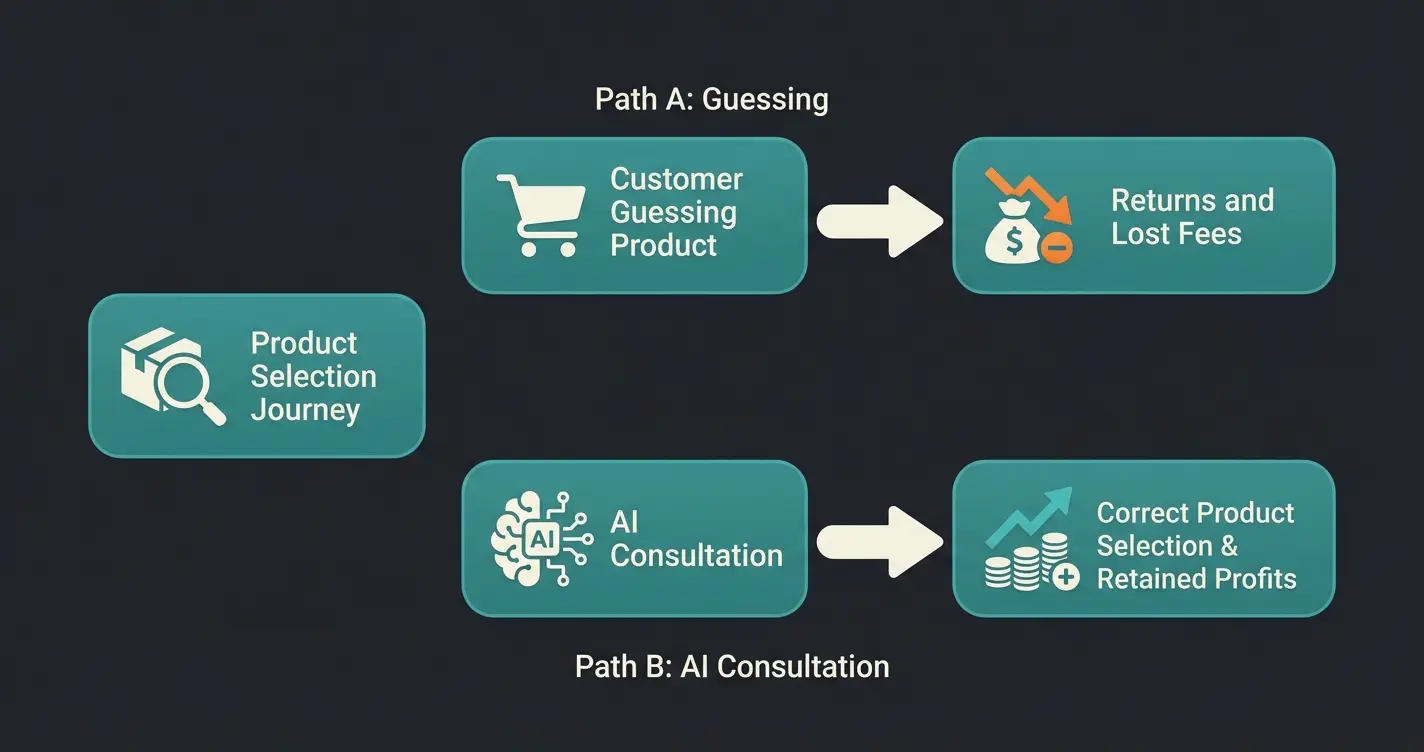

Here lies your biggest lever. Remember disadvantage #3? Shopify doesn't refund fees on returns.

Let's do the math: You sell fashion. Return rate: 40% (typical for Germany). Revenue: €100,000. Returns: €40,000. Paid payment fees (approx. 2%): €2,000. Of this, €800 applies to returned goods. This €800 is gone. Simply burned. Add shipping costs (there and back) and handling.

This is where modern technology comes into play: AI-powered product consultation. Instead of optimizing the checkout, you optimize the path there. An AI product consultation solution on your product page can recommend the right size based on customer data, clarify compatibility questions ('Does part X fit device Y?') instantly, and eliminate uncertainties before the 'Buy' button is clicked.

The Result: If you reduce the return rate from 40% to 30% through better consultation, you save not only logistics costs but directly €200 in pure payment fees (in our example)—and keep €10,000 more in revenue. Understanding how AI consultation in online shops works is becoming essential for competitive merchants.

Standard in German e-commerce

On €100k revenue with 40% returns

Achievable with AI product consultation

Plus logistics and handling costs

The smartest merchants don't just optimize checkout—they optimize the consultation before it. Our AI solution helps customers find the right product the first time, reducing returns and protecting your payment fees.

Start Your Free TrialTroubleshooting: Help, My Money Is Gone!

It's every merchant's nightmare: A red warning message in the dashboard. 'Payouts suspended.'

Why Does This Happen?

Shopify (and Stripe) must comply with anti-money laundering laws. When your behavior deviates from the pattern, the AI intervenes. Reasons: Sudden revenue increase (scaling), many chargebacks, incomplete documents in the backend.

Solution Checklist for Frozen Funds

- Stay Calm: Usually it's a routine check.

- Check Emails: Look for emails from the 'Shopify Risk Team' or 'Stripe.' Often only a photo of ID or a utility bill for address verification is requested.

- Don't Use VPNs: Never upload documents through a VPN. This is often evaluated as a fraud attempt.

- Document Quality: Scans must be colored, complete (all four corners visible), and easily readable. Phone photos are often better than scans, as EXIF data proves authenticity.

- Tracking Numbers: Consistently enter tracking numbers for all orders in Shopify. This proves to Shopify that you actually ship goods.

Understanding different types of chatbots and AI agents can also help you automate customer communication during payout holds, keeping customers informed and reducing disputes.

German-Specific Trust Factors and Psychology

Going deeper than just listing 'Klarna'—understanding the psychology of German buyers who fear credit cards is essential for conversion optimization. German consumers have distinctly different payment preferences than their American or British counterparts.

Invoice payment (Kauf auf Rechnung) remains the most trusted payment method because it allows customers to receive and inspect goods before paying. This 'try before you buy' mentality is deeply ingrained in German shopping culture, partly driven by strong consumer protection laws and a historical skepticism of pre-payment.

Credit card penetration in Germany is significantly lower than in other Western countries. Many Germans associate credit cards with debt risk, preferring debit cards (EC-Karte/Girocard) or direct bank transfers. This is why having Klarna and Sofortüberweisung activated isn't optional—it's mandatory for German market success. Communication via WhatsApp Business API can also build trust with German customers who prefer direct, personal communication.

Accounting & Tax Documentation for German Merchants

One often overlooked aspect of Shopify Payments in Germany is proper accounting (Buchhaltung). Shopify doesn't issue a classic 'monthly invoice' for withheld transaction fees since these are deducted directly from revenue.

For accounting (tax office/Finanzamt), you need to export the monthly payout reports. Tools like Pathway Solutions or Lexoffice integrations are highly recommended to automate accounting effort, as noted by What.Digital. As AI regulation evolves, staying compliant with the EU AI Act requirements becomes increasingly important for merchants using AI-powered tools.

Payout Schedule Optimization

In Germany, it typically takes 3 business days until the money is in your bank account, as confirmed by Shopify's payout documentation. You can set in the admin area whether you want to be paid out daily, weekly, or monthly.

Pro Tip for Cash Flow Management: Weekly payouts often provide the best balance between predictability and cash flow. Daily payouts can make reconciliation more complex, while monthly payouts may strain your working capital, especially during growth phases.

Conclusion: Activate, But Optimize Beyond the Basics

Is Shopify Payments the best solution for German merchants? Yes. At least as a foundation. The integration of Klarna, the elimination of penalty fees, and the clean dashboard make it almost without alternative for starting and growing.

But don't rely on the tool to secure your profitability:

- Activate Shopify Payments to avoid the 2% penalty fee.

- Add PayPal to win the trust of German customers.

- Fight the real cost drivers (returns) not through rate changes, but through better consultation—ideally automated through AI.

The e-commerce winner in 2025 isn't the merchant with the lowest credit card fees, but the one with the smartest processes.

FAQ: Frequently Asked Questions About Shopify Payments

In Germany, it typically takes 3 business days until the money is in your bank account. You can set in the admin area whether you want to be paid out daily, weekly, or monthly.

Yes. Shopify requires a business license or commercial register extract at the latest when certain revenue thresholds are reached. Without this, payouts are paused.

As a merchant, you don't need a credit card to receive Shopify Payments. To pay your Shopify invoices (subscription, apps), Shopify now often accepts PayPal or direct debit in Germany, but a credit card is often the easiest way for verification.

Shopify doesn't issue a classic 'monthly invoice' for withheld transaction fees since these are deducted directly from revenue. For accounting purposes, you need to export the monthly payout reports. Tools like Pathway Solutions or Lexoffice integrations are highly recommended.

Stay calm—it's usually a routine verification check. Check emails from the Shopify Risk Team, upload requested documents (ID, utility bill) without using a VPN, and ensure all orders have tracking numbers. Most holds are resolved within 3-14 days.

The real payment cost isn't the 2% fee—it's the returns eating your margins. Our AI product consultant helps customers buy right the first time, protecting your payment fees and boosting profits.

Try AI Product Consultation Free