Why Payment Choice Defines E-Commerce Success in Germany

Selecting the right WooCommerce payment solution is far more than a technical necessity for shop owners in Germany. It's a strategic decision about trust, legal compliance (GDPR), and conversion rates. While American guides often simply recommend Stripe, the German market operates differently: Security concerns, the desire for invoice payment, and strict data protection requirements dominate consumer expectations.

This comprehensive guide takes you deep into the landscape of WooCommerce payment options for 2025, analyzes the cost traps of major providers, and shows you how to transform your checkout from a technical form into a conversion-driving consultation tool. Whether you're setting up your first store or looking to optimize your checkout, understanding the German payment landscape is essential for success.

Why Checkout Is the Biggest Bottleneck in German E-Commerce

Many shop owners view the payment gateway as a simple "pipeline" for money. This is an expensive mistake. The checkout is the most psychologically sensitive moment of the customer journey—where trust either converts to sales or doubts lead to abandonment.

The Psychology of Payment

When a customer sees the credit card field or the "Buy" button, last-minute doubts often arise: "Will the package arrive on time?", "How complicated is the return process?", "Is my data transmission secure?" These psychological barriers can derail even the most interested buyers at the final moment.

Statistics paint a clear picture for the German market. According to Digital Magazin and WPBeginner, the average cart abandonment rate globally sits around 70%, with mobile devices in Germany often reaching up to 80%. Research from OMT indicates that one of the main reasons for abandonment is the lack of preferred payment methods or insufficient trust in the shop.

Global average cart abandonment rate across all devices

Cart abandonment rate on mobile devices in German market

Lack of preferred payment method or trust is the leading abandonment reason

The New Approach: Conversational Checkout with AI

Here lies a massive content gap in most guides. While competitors only discuss fees, you should understand the checkout as the final consultation step. Instead of leaving customers alone with their doubts, innovative shops integrate AI sales advisors directly into the checkout process.

Consider this scenario: A customer hesitates when purchasing an expensive e-bike in the checkout. The solution? An AI agent recognizes the hesitation and proactively offers help: "Are you unsure about the installment payment? With Klarna, you can pay for the bike in 30 days or finance it. Would you like me to show you the details?" The result: The AI functions as a sales associate at the register, clarifying objections in real-time and saving revenue that a static form would have lost.

This approach transforms your checkout from a technical hurdle into a service experience. If you're comparing platforms, understanding how different systems handle this is crucial—our Shopify vs WooCommerce comparison covers these differences in detail.

Top 5 WooCommerce Payment Gateways for Germany (2025 Comparison)

The German market is dominated by a mix of global giants and specialized European providers. Here's the analysis of the most important WooCommerce payment gateways for 2025. For an even deeper dive into plugin options, check out our comprehensive Shopware payment plugins comparison guide.

1. PayPal (PayPal Checkout / formerly Plus)

The undisputed market leader. A shop without PayPal is almost unthinkable in Germany due to the enormous brand trust consumers place in this payment method.

- Functionality: Offers not just the classic wallet, but also "Pay Later" (installment payment) and credit card acceptance through a single integration

- Fees (Standard): Approximately 2.49% + €0.35 per domestic transaction. International payments significantly increase fees (up to 3.99% + currency conversion) according to PayPal Fee Calculator

- Pro: Extremely high buyer trust; One-Touch checkout for returning customers

- Contra: Relatively high fees; account freezes on suspected ToS violations can be business-threatening

- Best For: Every shop as a baseline payment method

2. Stripe

The developer favorite and ideal for credit cards and digital wallets (Apple Pay / Google Pay). Stripe has become the backbone of modern e-commerce payment infrastructure.

- Functionality: Excellent API, seamless in-shop integration (no redirect), supports nearly all global currencies and methods

- Fees: 1.4% + €0.25 for European cards; 2.9% + €0.25 for non-European cards according to Transaktionsgebühren.com

- Pro: Cheaper than PayPal for EU cards; best UX for credit cards; Apple Pay integration is excellent

- Contra: No end-customer support (B2B only); funds are paid out with delay (rolling 3-7 days)

- Best For: Shops with international audiences and focus on credit cards/wallets

3. Mollie

The "rising star" from the Netherlands that has perfectly adapted to the European market. Mollie has gained significant traction among German merchants for its comprehensive feature set.

- Functionality: An "all-in-one" plugin for everything: PayPal, Klarna, credit card, Apple Pay, and local favorites like iDEAL (Netherlands) or Bancontact (Belgium)

- Fees: Transparent "blended pricing" models. Approximately 1.80% + €0.25 for credit cards; Klarna from approximately 2.99% + fixed fee according to Mollie Pricing. No monthly fixed costs

- Pro: One plugin for all European payment methods; very nice dashboard; German localization is excellent

- Contra: Slightly more expensive for credit cards than Stripe directly

- Best For: German shops wanting to cover all relevant EU payment methods with one plugin

4. Klarna (via Stripe/Mollie or Direct)

Essential for "invoice payment" (Kauf auf Rechnung) and installment purchases. Klarna has become synonymous with flexible payment options in the DACH region.

- Functionality: Takes over the risk for invoice purchases. The merchant receives their money immediately, Klarna collects from the customer

- Fees: Variable, often around 2.99% + €0.35 per transaction according to Websei

- Pro: Massive conversion booster for high cart values (fashion, electronics)

- Contra: High fees; Klarna takes over the customer relationship (marketing emails from Klarna to your customers)

- Best For: B2C shops with cart values over €50

For shops running subscription models, understanding payment gateway compatibility is crucial. Our woocommerce Subscriptions guide covers the specific requirements for recurring payments in detail.

5. WooPayments

The native solution from WooCommerce (technically based on Stripe). This offers the most seamless integration with the WordPress ecosystem.

- Functionality: Deeply integrated into the WordPress dashboard. You don't have to leave the shop to manage payments

- Fees: Similar to Stripe (approximately 1.4% + €0.25 for EU cards), but often promotions for new customers according to WooCommerce

- Pro: Everything in one place; simple setup process

- Contra: Less flexible than a direct Stripe account; support runs through WooCommerce (ticket system)

- Best For: Beginners seeking an "out-of-the-box" solution

If you're comparing costs with other platforms, understanding fee structures across different systems helps. Our Shopify Payments Germany guide provides a detailed breakdown of what you can expect on alternative platforms.

Market Disruptions 2025: The End of Giropay and Launch of Wero

A critical point that many outdated blog articles miss: Do not install Giropay anymore! This is perhaps the most significant change German e-commerce merchants need to understand for 2025.

The Death of Giropay

The German online payment method from banks and savings banks, Giropay, was officially discontinued on December 31, 2024 as reported by Zinsen.net and PCWelt. It couldn't compete against PayPal's market dominance. Plugins that only offer Giropay are now completely useless.

The Future: Wero

The successor is called Wero (European Payments Initiative), representing a major shift in the European payment landscape.

- What is it? A European wallet enabling real-time transfers (account-to-account) and reducing dependence on US providers (Visa/Mastercard/PayPal)

- Status 2025: Wero has launched in Germany for P2P (phone to phone). E-commerce integration (online shops) is rolling out broadly only in late 2025/early 2026 according to Wikipedia

- Recommendation: Currently there are hardly any stable standalone plugins for WooCommerce. Use aggregators like Mollie or Stripe, as these will likely integrate Wero first once it becomes available according to Stripe

Reduce cart abandonment with AI-powered customer consultation. Answer buyer questions instantly at the point of purchase and convert hesitant browsers into confident customers.

Start Free TrialComparison Table: Fees & Features (2025 Status)

Understanding the complete fee structure helps you make informed decisions. This comparison covers the key factors German merchants need to evaluate when choosing their WooCommerce payment gateway.

| Provider | Transaction Fee (EU Cards/Standard) | Transaction Fee (Intl. Cards) | Monthly Base Fee | Guaranteed Invoice Payment | GDPR Server Location |

|---|---|---|---|---|---|

| PayPal | ~2.49% + €0.35 | up to 3.99% + fixed | €0 | Yes (via PayPal) | USA/EU (mixed) |

| Stripe | 1.4% + €0.25 | 2.9% + €0.25 | €0 | No (only via Klarna addon) | USA/EU (strong EU presence) |

| Mollie | ~1.80% + €0.25 | ~2.90% + €0.25 | €0 | Yes (via Klarna) | Europe (Netherlands) |

| Klarna | ~2.99% + €0.35 | N/A | €0 | Yes (core feature) | Sweden/EU |

| WooPayments | ~1.4% + €0.25 | 2.9% + €0.25 | €0 | Via integration | USA/EU |

Essential German Payment Methods (Zahlungsarten)

Understanding the difference between payment gateways (the technology) and payment methods (the customer's choice) is crucial for optimizing your WooCommerce payment setup. German consumers have distinct preferences that differ significantly from other markets.

The German Payment Method Trust Hierarchy

German consumers rank payment methods by trust level, not convenience. This hierarchy directly impacts your conversion rates and should guide your implementation priorities.

- Invoice (Rechnung): Highest trust - customer pays after receiving goods, eliminating purchase risk

- PayPal: Strong trust through buyer protection and familiar brand recognition

- Direct Debit (Lastschrift/SEPA): Trusted for recurring payments, common for subscriptions

- Sofort/Online Banking: Immediate bank transfer, moderate trust level

- Credit Card: Lower trust in Germany compared to US/UK markets, but essential for international customers

- Digital Wallets: Apple Pay/Google Pay growing but still niche in the DACH region

This trust hierarchy explains why offering Klarna's invoice option can boost conversion by 20-30% for German customers, despite the higher fees. Building your shop into an AI sales machine means understanding these cultural payment preferences.

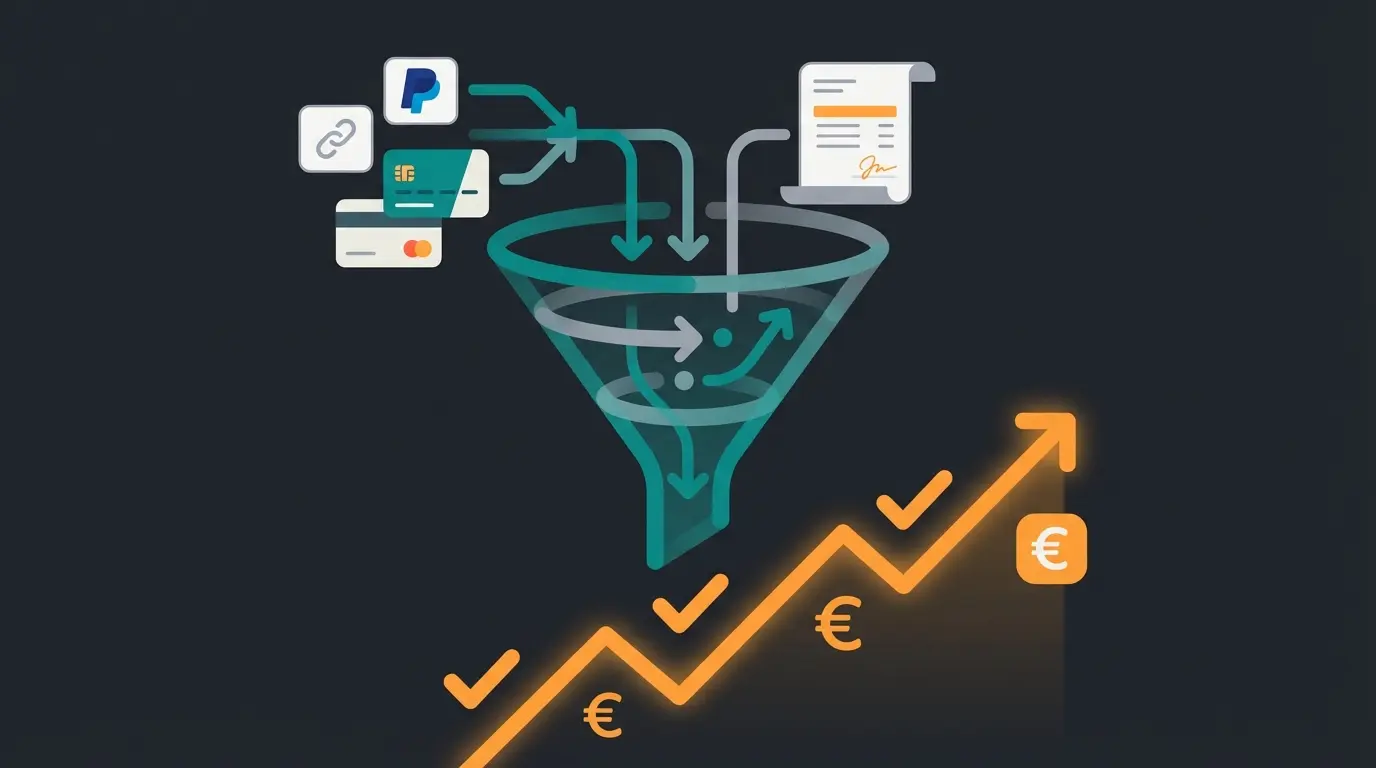

The "Hidden" Costs: Fees vs. Conversion Rate

Many merchants make the mistake of only looking at the "transaction fee" column. This narrow focus can be extremely costly in terms of lost revenue.

Consider this example: Gateway A costs 1.4%. Gateway B costs 2.5%. The simple logic suggests choosing Gateway A to save money. However, the trap lies elsewhere entirely.

If Gateway A has a poor UX (e.g., redirect to an ugly bank page, no Apple Pay support), perhaps 5% more customers abandon. Let's calculate the real cost:

- At €10,000 revenue, Gateway B (2.5%) costs €110 more in fees than Gateway A

- But if Gateway B saves 5% more revenue through better UX (One-Click, trust signals), that's +€500 in recovered sales

- Net result: You make €390 more profit despite higher fees

Determine if you sell subscriptions, one-time products, or high-ticket items

Subscriptions need Stripe/Mollie; High-ticket benefits from Klarna's pay-later options

Factor in conversion rates, not just transaction fees

A/B test checkout flows and monitor abandonment rates

Conclusion: Optimize your checkout for conversion, not fee minimization. Offer the mix that customers want (PayPal + Invoice + Credit Card). The product consultant guide explains how AI-assisted selling further improves these conversion rates.

Technical Setup & Legal Compliance (Germanized)

In Germany, simply installing a payment plugin isn't enough. You must observe strict legal requirements (button solution, GDPR) that are unique to the German market. For comprehensive guidance on legal compliance Germany, we've created a dedicated resource.

1. The Foundation: Germanized for WooCommerce

Before setting up the payment gateway, install the plugin Germanized for WooCommerce as documented on WordPress.org and Vendidero.

- Why? It ensures that checkboxes for terms/conditions and cancellation policy are correctly placed, emails are legally compliant, and the "Buy" button meets legal requirements

- Payment Integration: Germanized offers special compatibilities with gateways like PayPal and Stripe to ensure that delivery times are correctly transmitted in payment provider confirmation emails

- Button Solution: German law requires the purchase button to clearly indicate a payment obligation (e.g., "Buy Now" must be "Kostenpflichtig bestellen")

2. GDPR Checklist for Payments

Data protection compliance is non-negotiable for German merchants. Here's what you must implement:

- Privacy Policy: Every payment service provider must be named in your privacy policy with specific details about data processing

- Data Processing Agreement (DPA): Conclude a DPA contract with the provider (Stripe, PayPal, Mollie) - usually available digitally in their dashboard

- No Automatic Loading: Scripts from payment providers (like PayPal JS) should ideally only load when the customer consents or enters the checkout to avoid unnecessary tracking

For AI-powered features, ensuring GDPR compliant AI implementation is equally important when integrating consultation tools into your checkout.

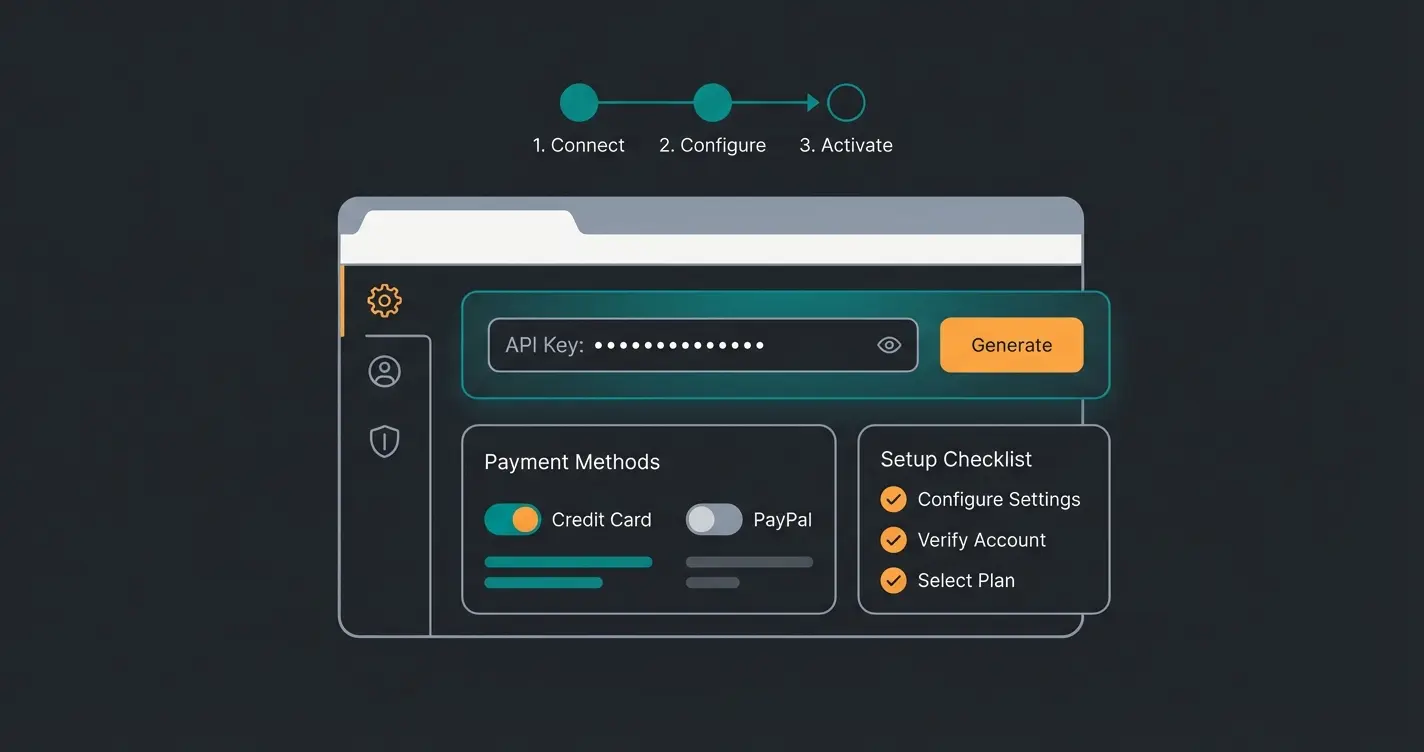

3. Step-by-Step Installation (Mollie Example)

Here's a practical walkthrough for setting up one of the most versatile payment gateways for the German market:

- Create Account: Register at Mollie.com and upload company data (commercial register, ID verification)

- Install Plugin: Search for "Mollie Payments for WooCommerce" in the WordPress backend and install

- Connect API Keys: Copy the "Live API Key" from the Mollie dashboard into the plugin settings

- Activate Methods: Check the boxes for PayPal, Credit Card, Klarna, Apple Pay, and other desired methods

- Test Mode: Always run a test order before going live to verify the complete checkout flow

Reducing Payment Abandonment with AI (Your Competitive Edge)

We've established that customers abandon purchases because questions remain unanswered. The classic solutions are FAQ pages (which nobody reads during checkout) or chatbots (which often annoy more than help). The modern solution is an integrated AI product consultation system.

How AI Saves Revenue at Checkout

Imagine the customer selects "Credit Card" but hesitates before clicking "Buy." They're wondering: "What happens if the item doesn't fit? How long does the refund to my credit card take?"

An AI customer service solution trained on your shop data can answer directly in an overlay: "No worries. For credit card payments, we typically process returns within 3 business days of receipt. Return shipping is free." This transforms the checkout from a technical hurdle into a service experience, building trust exactly where money changes hands.

The Conversational Checkout Advantage

Unlike static FAQ pages, an AI-powered conversational checkout can address concerns contextually. When a customer hovers over Klarna, the AI might proactively offer: "Interested in paying later? With Klarna, you can receive your items first and pay within 30 days - with no additional fees."

This proactive approach can reduce cart abandonment by 15-25% according to industry benchmarks. The key is integrating the AI seamlessly without being intrusive—available when needed but not blocking the purchase flow.

Frequently Asked Questions

It depends on your customer base. PayPal has higher trust among German consumers and is expected by most shoppers. Stripe offers lower fees for EU credit cards (1.4% vs 2.49%) and better developer tools. The best approach is offering both: PayPal for trust and Stripe for credit card/Apple Pay transactions.

Yes, for most payment gateways you need a registered business (Gewerbeanmeldung) or company registration (Handelsregister). PayPal allows personal accounts with limitations, but for serious e-commerce, a business account with proper KYC verification is required by all major providers.

Giropay was discontinued on December 31, 2024. Its successor Wero is launching for P2P payments first, with e-commerce integration expected in late 2025/early 2026. Currently, don't add Giropay plugins (they're useless) and wait for Wero integration through aggregators like Mollie or Stripe.

Install the Germanized plugin, list all payment providers in your privacy policy, sign Data Processing Agreements (DPAs) with each provider, and ensure payment scripts only load when necessary. The 'Buy' button must also meet German legal requirements for clarity about payment obligations.

Invoice payment (Kauf auf Rechnung) via Klarna or PayPal has the highest conversion rate in Germany, especially for carts over €50. German consumers prefer paying after receiving goods. Despite higher fees (around 2.99%), the conversion boost typically outweighs the additional cost.

Conclusion & Success Checklist

Choosing the right WooCommerce payment gateway determines success or failure in German e-commerce. Don't rely solely on fee comparisons—focus on trust and user experience. The German market rewards merchants who understand local payment preferences and legal requirements.

Your 2025 Action Checklist

- Offer the right mix: PayPal, Credit Card (Stripe/Mollie), and Invoice Payment (Klarna) are mandatory for German customers

- Remove Giropay: Deactivate old Giropay integrations immediately—they no longer function

- Watch for Wero: Monitor your provider (Mollie/Stripe) for Wero integrations expected late 2025

- Use Germanized: Ensure your checkout is legally compliant with German regulations

- Integrate AI consultation: Consider how AI tools can eliminate last-minute purchase barriers in the checkout process

Optimize your gateway for fees, but optimize your checkout for answers. Only then will you sustainably maximize your profit. The combination of the right payment mix, legal compliance, and intelligent customer consultation creates a checkout experience that converts browsers into buyers.

Stop losing sales to unanswered questions. Our AI consultation platform integrates seamlessly with WooCommerce to provide real-time customer support exactly when it matters most—at checkout.

Get Started Free