Introduction: The B2B Invoice Purchase Dilemma

In B2B e-commerce, Shopware B2B invoice purchase is not merely an option—it's hard currency. While wallets like PayPal dominate the B2C space, business customers expect the ability to pay on account. If this option is missing at checkout, professional buyers often abandon the process entirely. However, for merchants, invoice purchase is a double-edged sword: it maximizes conversion rates while simultaneously opening the door to payment defaults and high administrative overhead.

The current discussion within the Shopware ecosystem focuses heavily on two camps: technical implementation (How do I configure the Rule Builder?) and financial protection (Should I use factoring providers like Billie or Mondu?). What is often overlooked is the root cause of many payment problems: the incorrect order. According to onlinehaendler-news.de, invoice purchase maintains a revenue share of over 26% in the overall e-commerce mix.

In this comprehensive guide, we not only illuminate the technical integration of invoice purchase in Shopware 6 (including the transition from B2B Suite to B2B Components) but also expand the perspective to include a decisive factor: how AI-powered product consultation functions as preventive risk management and makes invoice purchase more profitable.

Part 1: The Status Quo – Why Invoice Purchase Is Essential

Business Customer Expectations

Data from the EHI Retail Institute and other market observers consistently confirm: invoice purchase is the preferred payment method in the DACH region (Germany, Austria, Switzerland). Research from bsz-bw.de shows that invoice purchase is essential for conversion rates in B2B commerce. While PayPal leads in the general e-commerce mix (B2C & B2B combined), invoice purchase remains extremely strong.

In the pure B2B context, this picture shifts even more dramatically. Here, invoice purchase is often "standard" because it integrates seamlessly into the accounting processes of purchasing companies. Buyers don't want to use a company credit card; they want an invoice that can be reviewed, recorded, and settled within a payment term (e.g., net 30 days).

Business customers prefer invoice payment over other methods

Invoice purchase maintains in overall DACH e-commerce

Typical net payment window for B2B invoices

The Risks for Merchants

Offering Shopware B2B invoice purchase brings three main problems:

- Liquidity binding: The merchant advances the goods before receiving payment.

- Credit risk (Delcredere): The danger that the customer becomes insolvent or simply doesn't pay.

- Operational overhead: Dunning processes, credit checks, and—especially in B2B—handling invoice corrections for returns.

Part 2: Technical Implementation in Shopware 6

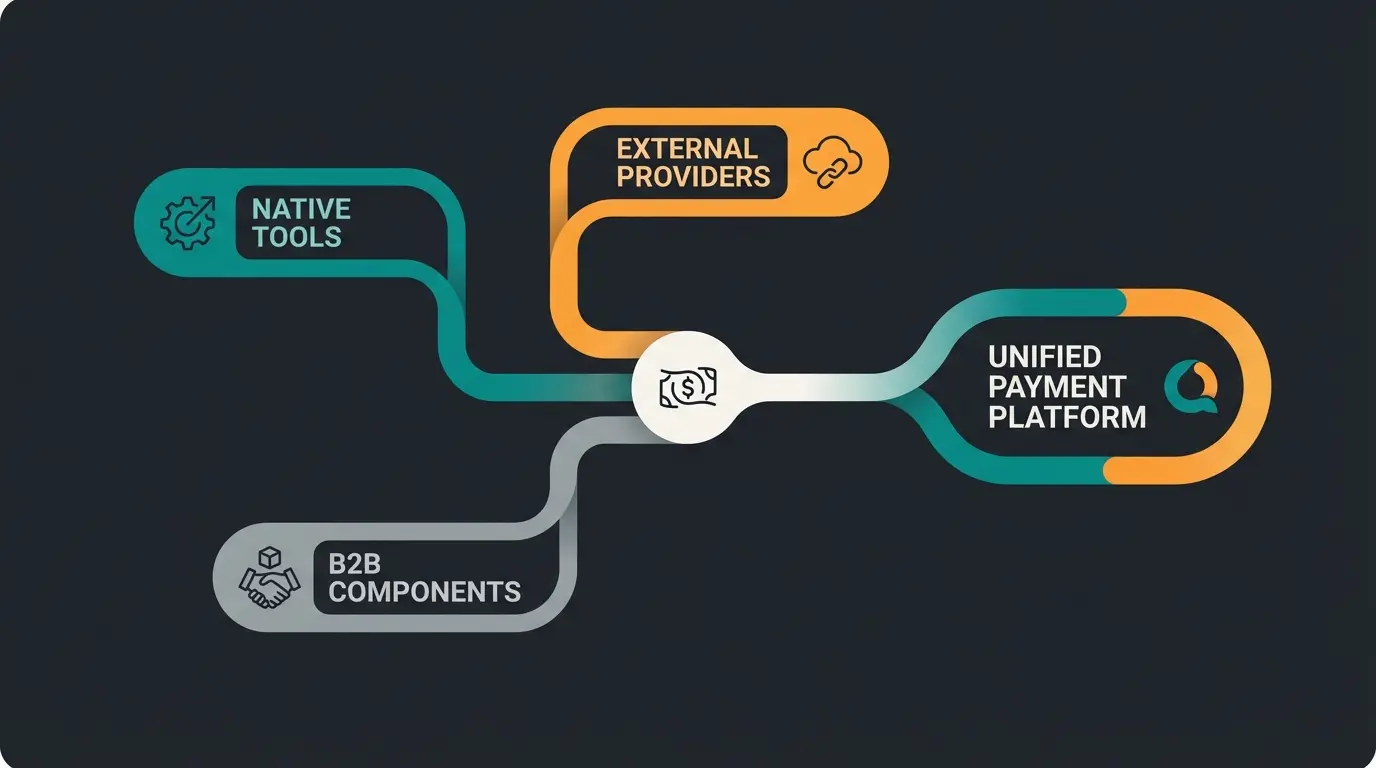

To offer invoice purchase securely in Shopware 6, merchants have various options available. The choice of method depends heavily on the Shopware license (Rise, Evolve, Beyond) and risk appetite. Understanding Shopware AI features can help you leverage the platform's full potential for B2B commerce.

Option A: Shopware Native Tools (Rule Builder & Customer Groups)

For merchants who don't want to pay external fees to factoring providers, the Shopware 6 Shopware Rule Builder offers powerful tools to offer invoice purchase only to trusted customers.

Implementation Steps:

- Step 1: Create a custom field on the customer record, e.g., `b2b_invoice_allowed` (checkbox).

- Step 2: Create a rule in the Rule Builder: Name: "Customer may purchase on invoice" / Condition: `Customer.CustomField.b2b_invoice_allowed` IS `active`.

- Step 3: Link this rule in the payment method settings under "Availability".

Strategy: Dynamic Risk Distribution

The Rule Builder also allows more complex logic according to konvis.de:

- Cart value: Invoice purchase only up to €5,000.

- Number of orders: Invoice purchase only after the 3rd successful order (`Number of orders >= 3`).

- Customer group: Only for the "Regular customers" group, not for "Guest customers".

Option B: External Payment Providers (BNPL & Factoring)

To completely outsource the financial risk, many Shopware merchants integrate specialized B2B-BNPL providers (Buy Now, Pay Later) like Billie or Mondu. According to Shopware's store, these providers offer seamless checkout integration.

Advantages:

- Immediate liquidity: The provider pays the merchant immediately (minus fee), even if the customer doesn't pay for 30 days.

- Real-time scoring: The buyer's creditworthiness is checked in milliseconds during checkout (up to €100,000 cart value with Billie, as noted on Shopware.com).

- Protection: 100% default protection against fraud or customer insolvency.

Disadvantages:

- Costs: Transaction fees reduce the margin.

- Data sovereignty: The customer relationship in the dunning process partially lies with the service provider.

Option C: B2B Suite vs. B2B Components (Strategic Shift)

There is often confusion here. Shopware is in a transition period, as detailed by splendid-internet.de.

1. Shopware B2B Suite (Legacy):

This was long the standard solution for complex B2B shops. It is a monolithic plugin that adds features like budgets, quotas, and approval processes.

- Status: No longer actively developed (feature freeze) and will be discontinued with Shopware 6.8, according to Shopware documentation.

- Invoice purchase relevance: Enabled setting budgets per debitor. When the budget was exceeded, invoice purchase was blocked.

2. Shopware B2B Components (The Future):

Starting with the Evolve plan, Shopware relies on modular "Components." These are API-first and more deeply integrated into the core, as explained on Shopware.com.

- Budgets & Quotas: A central feature of the Components (available from Evolve). Merchants can define budgets. When a buyer reaches their budget limit, an approval workflow (Approval Flow) is automatically triggered, according to Shopware's B2B documentation.

- Integration: Unlike the old Suite, the Components use the standard Flow Builder and Rule Builder. This means you can now build rules like: "If budget exceeded AND customer from Germany -> Trigger Approval Flow", as detailed in Shopware's Flow Builder guide.

| Feature | B2B Suite (Legacy) | B2B Components | Plugins (Billie/Mondu) |

|---|---|---|---|

| Functionality | Budgets, quotas, approval processes | Modular budgets & quotas, API-first | Real-time credit scoring, factoring |

| Setup Difficulty | Medium-High | Medium | Low (plugin install) |

| Cost | Included in older plans | Requires Evolve/Beyond plan | Transaction fees |

| Best For | Existing shops on older versions | New B2B projects, future-proofing | High-risk tolerance, new customers |

| Integration Depth | Parallel to core | Deep core integration | Checkout layer only |

Part 3: The Hidden Costs – Returns & Disputes

Most discussions end at the credit check. But in the B2B sector, "non-payment due to insolvency" is often less common than "non-payment due to dispute." This is where AI-driven product consultation becomes crucial.

The "Pre-Checkout" Problem

When a B2B customer orders a technical component that doesn't fit their machine, they won't pay the invoice. They will complain, return the goods, or demand a credit note.

- Cost factor: A B2B return is extremely expensive. In addition to shipping costs (often freight), there are costs for inspection, restocking, and depreciation. Studies show that return costs average between €5 and €10 per item, but increase exponentially for complex goods, according to research from sazsport.de.

- Process costs: Every invoice purchase that ends in a return creates accounting overhead (cancellation, credit note, new invoice). Data from onlinehaendler-news.de confirms these costs significantly impact B2B margins.

This is where pure financial tools like Billie or Mondu fail. They check whether the customer can pay, but not whether they are buying the right thing.

Is this a real, legitimate company? Basic KYC and business verification.

Can they pay? Credit scoring and financial risk evaluation.

Are they buying the right product? Technical validation prevents returns—your competitive advantage.

Discover how AI-powered product consultation can reduce returns by validating purchases before checkout. Stop losing money on incorrect orders.

Start Free TrialPart 4: Next-Level Strategy – AI-Guided Purchasing

To truly secure Shopware B2B invoice purchase, we must minimize risk before checkout. This is where Artificial Intelligence comes into play—not as a gimmick, but as an operational risk manager. Understanding how AI Selling revolutionizing commerce is essential for forward-thinking B2B merchants.

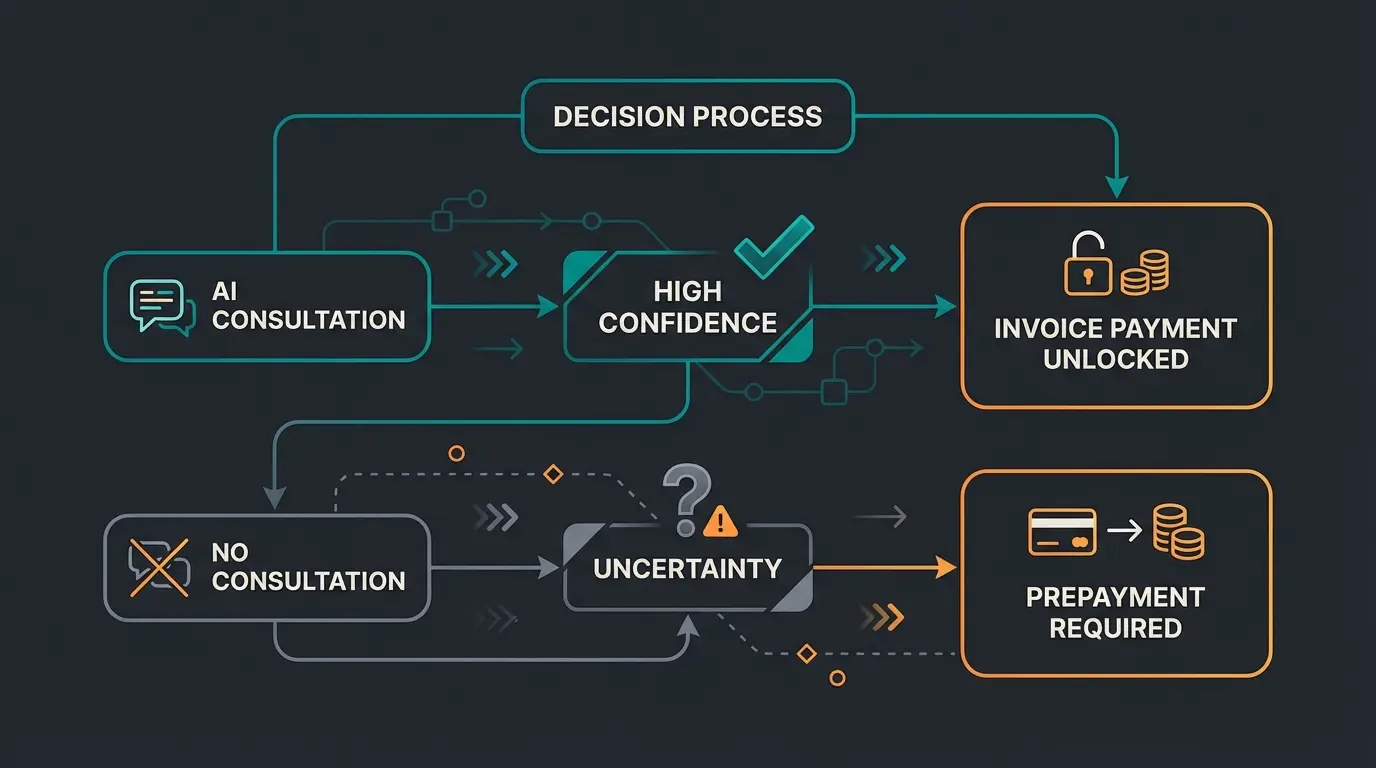

The Concept: Consultative Sales Through AI

Imagine invoice purchase being unlocked not just based on creditworthiness, but based on the quality of the shopping cart. This approach leverages AI consulting in e-commerce to fundamentally change how B2B transactions are validated.

The Workflow:

- Customer enters the shop: Searches for a spare part.

- AI interaction: An integrated AI assistant (based on your product data and compatibility lists) actively asks about requirements (e.g., "Which machine series do you need this valve for?"). This is how AI-powered product advice transforms the buying experience.

- Validation: The AI confirms: "This part is 100% compatible with your system X."

- Risk assessment: Since technical uncertainty has been eliminated, the return risk drops to nearly zero.

- Reward: The Shopware Rule Builder recognizes the status "Consultation Verified" and unlocks invoice purchase—perhaps even with a higher limit than for a "blind purchase."

Why This Increases Profitability

Implementing AI Product Consultation delivers measurable business impact:

- Fewer returns: The customer gets what they need. The invoice isn't disputed.

- Higher limits: You can confidently grant higher invoice limits since the operational risk (incorrect order) is minimized.

- Customer loyalty: The customer feels advised, not just "processed." This is how AI-powered sales consultants build lasting relationships.

The implementation of AI sales agents represents the cutting edge of B2B commerce optimization. By leveraging AI Product Consultation, merchants can fundamentally transform their risk profile while improving customer satisfaction.

Part 5: Comparison – Financial vs. Operational Protection

To find the right strategy for your Shopware shop, it's worth comparing the approaches. This is particularly relevant when implementing AI-powered product consultation alongside traditional payment security measures.

| Feature | Financial Protection (e.g., Billie/Mondu) | Operational Protection (AI Consultation) |

|---|---|---|

| Main Goal | Protection against payment default (insolvency) | Protection against returns & disputes (wrong purchase) |

| Mechanism | Real-time credit check | Technical validation of shopping cart |

| Costs | Transaction fee (%) | Implementation costs / license |

| Impact on Returns | Low (doesn't solve the problem) | High (prevents the problem) |

| Shopware Integration | Plugin (payment method) | Integration (frontend/chatbot) |

| Ideal For | New customers, guest buyers | Complex product ranges, products requiring explanation |

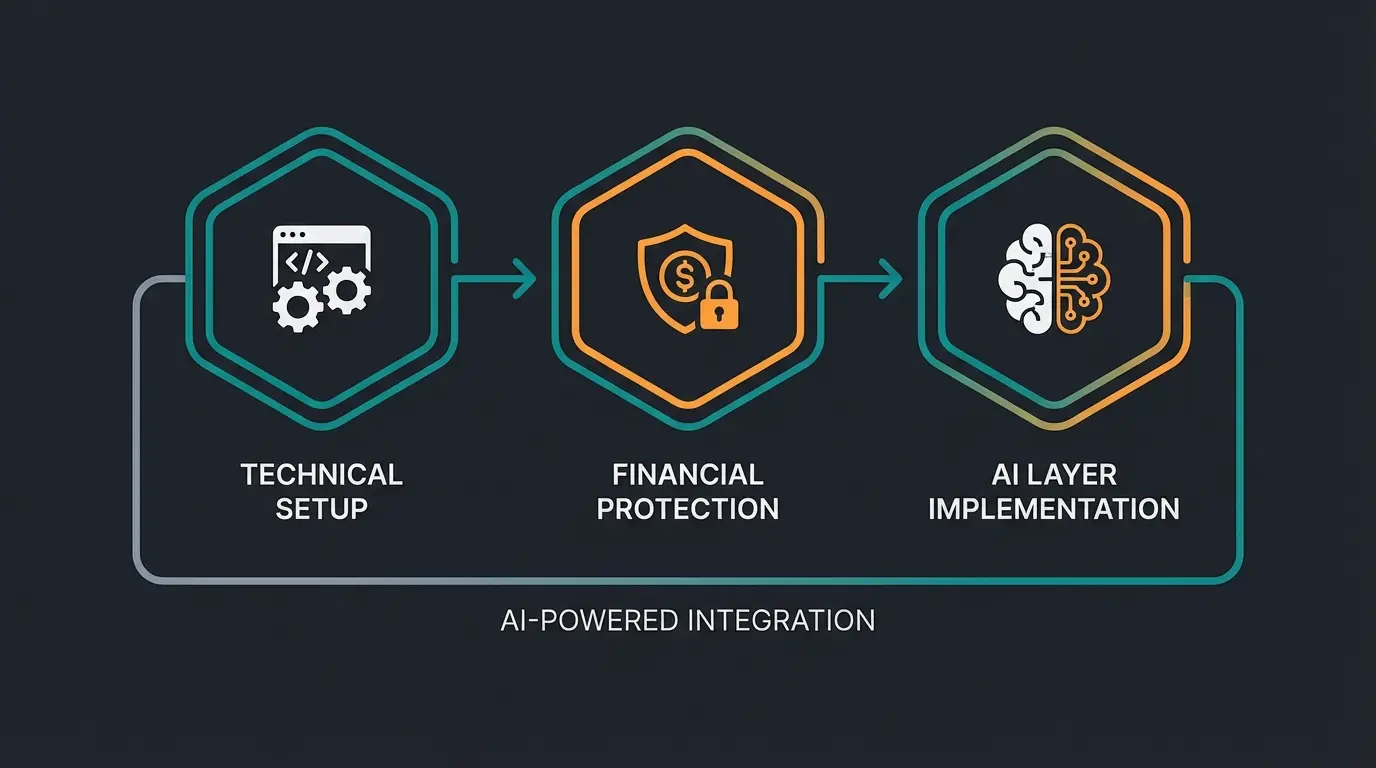

Part 6: Checklist – Setting Up a Secure B2B Invoice Workflow

Follow these steps to build a robust process in Shopware 6:

Step 1: Technical Foundation (Shopware B2B Components)

- Ensure you (for new projects) are using the B2B Components (Evolve/Beyond plan).

- Configure Budgets for your business customers. Define how much each employee can order without approval.

- Use the Flow Builder to automatically notify the supervisor for approval when budgets are exceeded.

Step 2: Financial Protection (Rule Builder & Providers)

- Decide: Do you want to bear the risk yourself or outsource it?

- Self-funding: Use the Rule Builder. Rule: `Customer.TotalOrderValue > 0` AND `Customer.TotalOrderValue < 10,000` AND `Country = DE`.

- Factoring: Install the plugin from Billie or Mondu for the checkout process.

Step 3: Operational Protection (AI Layer)

- Implement an AI solution that has access to your technical data sheets.

- Link (if possible) the consultation status with checkout. A "verified shopping cart" could be positively rated in scoring.

- Integrate the AI consultation as a prerequisite for higher invoice limits.

FAQ: Common Questions About Shopware B2B Invoice Purchase

Yes, this is very easy via the Rule Builder. Create a rule "Is customer group X" and assign this rule to the payment method "Invoice" in the Availability section. You can also combine this with conditions like "Number of previous orders." According to mageplaza.com, this granular control is one of Shopware's key B2B strengths.

The B2B Suite is an older plugin that brings its own logic for budgets and approvals that partially runs parallel to the Shopware core. The B2B Components are the modern successor (from Evolve plan), deeply integrated into the Shopware core (Flow Builder, Rule Builder). With the Components, you can control payment approvals much more flexibly via the Flow Builder.

By ensuring before the purchase that the product technically fits the customer's needs. This prevents incorrect orders, which in the B2B sector are the most common cause of invoice reductions and payment delays. AI consultation validates technical compatibility before the order is placed.

For merchants with many new customers or high shopping cart values, often yes. The fees (usually in the low percentage range) are often cheaper than the costs of a single payment default or the effort for a manual credit check. They provide immediate liquidity and 100% default protection.

Yes, modern AI consultation solutions can be integrated to work alongside the Rule Builder. You can create rules that recognize "Consultation Verified" status and adjust payment availability accordingly—for example, unlocking higher invoice limits for validated purchases or requiring AI consultation before invoice payment becomes available.

Conclusion: The Future of B2B Invoice Purchase

Shopware B2B invoice purchase is not purely a financial topic. It is an interplay of technical configuration (B2B Components), financial protection, and—increasingly important in the future—intelligent sales consultation. Those who view invoice purchase only as a "payment method" are leaving potential on the table and risking high return costs. However, those who understand it as part of an AI-supported customer journey create a competitive advantage: maximum security for the merchant with maximum convenience for the buyer.

The key insight is that traditional risk management only addresses half the equation. While credit checks and factoring protect against financial default, they do nothing to prevent the operational costs of returns, disputes, and administrative overhead. By implementing AI-powered consultation before checkout, you address the root cause of most B2B payment problems: the incorrect order.

See how AI-powered product consultation can reduce your return rates, increase invoice limits, and transform your B2B customer experience. Join forward-thinking merchants who are already benefiting.

Get Started Today