Why WooCommerce Doesn't Write Invoices (And Why You Must Act)

Did you know that WooCommerce cannot create legally compliant invoices by default? It's one of the first obstacles new store owners encounter: a customer places an order, WooCommerce sends an order confirmation email – but where's the invoice? The sobering answer: there isn't one. At least not "out of the box."

But in 2025, the problem has grown beyond just a missing PDF file. With the introduction of the mandatory e-invoice requirement in the B2B sector starting January 1, 2025, a simple PDF is often no longer sufficient for business customers. If you don't act now, you risk warnings and trouble with tax authorities.

In this comprehensive guide, we'll show you not only how to automatically create WooCommerce invoices, but also how to make your store compliant with ZUGFeRD and XRechnung standards. We compare the best plugins, demonstrate integration with accounting tools like sevDesk or Lexoffice, and explain how you can revolutionize your sales operations after automating your accounting. Similar automation principles apply across platforms, as covered in our Shopware E-Invoice Guide.

WooCommerce is an American plugin. In the USA (and many other countries), a simple receipt or the order overview in an email is often sufficient. However, German tax law, particularly the GoBD (Principles for the Proper Management and Storage of Books, Records, and Documents in Electronic Form and for Data Access), sets strict requirements:

- Sequential invoice numbers: These must be consecutive and unique. Order numbers in WooCommerce are not (since abandoned carts or blog posts also consume IDs).

- Mandatory information: Tax number, service period, displayed VAT (7% vs. 19%), and correct address data.

- Immutability: Once an invoice is created, it cannot be subsequently modified without documentation (cancellation/correction invoice).

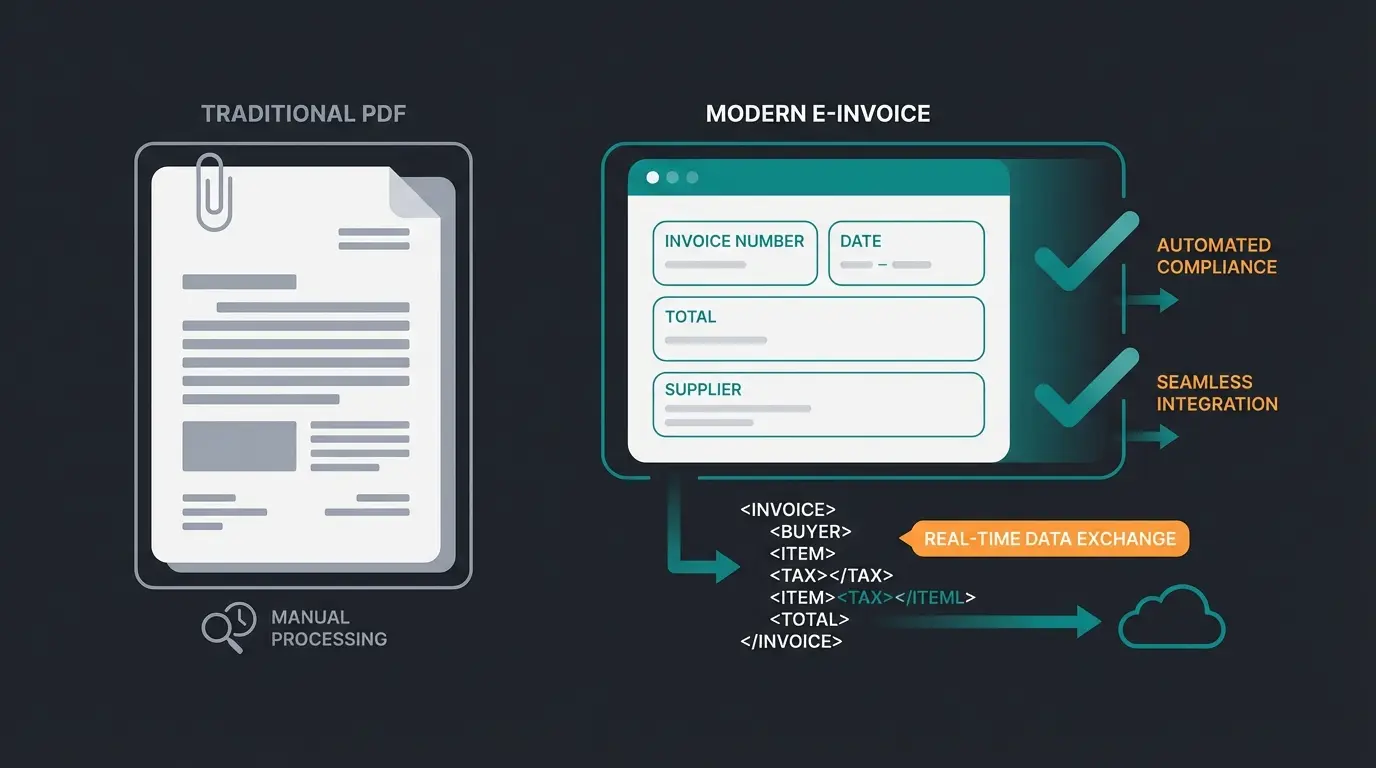

When you search for "WooCommerce invoice creation" or "WooCommerce PDF invoice," you'll mostly find solutions that generate simple PDFs. But starting in 2025, a new dimension is added: machine readability. Understanding these compliance requirements is essential, especially when dealing with B2B invoice purchase scenarios.

The 2025 Game-Changer: E-Invoice vs. PDF Invoice

Many store owners feel falsely secure: "I already send PDFs by email, that's electronic, right?"

No. According to the new legislation (Growth Opportunities Act), a new definition applies in the B2B sector (business-to-business transactions) starting January 1, 2025. As explained by Haufe, this represents a fundamental shift in how invoices must be processed.

The Difference in Detail

| Feature | Classic PDF Invoice | E-Invoice (from 2025) |

|---|---|---|

| Format | Image-based document (human-readable) | Structured data set (XML) (machine-readable) |

| Standard | No technical standard | EN 16931 (ZUGFeRD or XRechnung) |

| Processing | Must be manually typed or OCR scanned | Can be automatically posted by accounting software |

| Legal Status from 2025 (B2B) | Counts as "other invoice" (like paper) | Counts as legal standard |

What is ZUGFeRD?

For WooCommerce store operators, ZUGFeRD (Central User Guide of the Forum for Electronic Invoicing Germany) is the most important format. It's a hybrid format:

- You see a completely normal PDF (visual).

- Invisibly embedded in this PDF is an XML file containing all invoice data.

The advantage: Your customer can read the invoice, and their accounting software can import the data. This seamless data exchange is similar to how DATEV export functionality streamlines accounting workflows.

Reception obligation: Every German B2B company must be able to receive e-invoices

Transition period: Paper invoices and normal PDFs still allowed with recipient consent

Extended period for companies with revenue under €800,000

E-invoice becomes mandatory without alternatives for all B2B transactions

The Deadlines: Do You Need to Switch Immediately?

There's often panic here. The facts are as follows, according to the IHK and WKO Austria:

- Reception obligation (From Jan 1, 2025): Every German B2B company must be technically capable of receiving an e-invoice. If your supplier sends you an XRechnung, you cannot reject it.

- Issuance obligation (With transition periods): Until Dec 31, 2026, paper invoices or normal PDFs (with recipient consent) may still be sent for B2B transactions. Until Dec 31, 2027, this still applies to companies with previous year revenue under €800,000. From 2028, e-invoicing in B2B is without alternative.

Solution A: The Plugin Method (Ideal for Small to Medium Shops)

For most store operators, a plugin is the simplest solution to generate WooCommerce invoices. Here are the three top candidates for the German market that also serve international shops.

1. Germanized for WooCommerce (Pro)

The market leader for legal compliance.

Germanized is more than just an invoice plugin; it adapts the entire shop to German law (delivery times, checkboxes, terms and conditions). According to Vendidero, the Pro version fully supports ZUGFeRD (Profiles: Basic, Comfort, Extended) and XRechnung.

- E-Invoice: The Pro version supports ZUGFeRD (Profiles: Basic, Comfort, Extended) and XRechnung comprehensively.

- Automation: Creates invoices automatically on order status change (e.g., "Processing" or "Completed") and attaches them to emails.

- Cost: Free basic version (PDFs possible), Pro version (for e-invoice & automation) approx. €79/year.

2. German Market

The strong alternative.

Similar to Germanized, German Market offers a complete solution for the DACH region. As noted by E-Rechnung Einfach Sicher and MarketPress, it offers dedicated invoice PDF add-ons that create ZUGFeRD-compliant PDFs.

- E-Invoice: Offers a dedicated "Invoice PDF Add-On" that creates ZUGFeRD-compliant PDFs. You can choose whether the XML is embedded or attached separately.

- Special feature: Very good support and integrations for Billbee and Lexoffice.

- Cost: Approx. €75/year.

3. WooCommerce PDF Invoices & Packing Slips (WP Overnight)

The international standard.

This is the world's most frequently used plugin for WooCommerce PDF invoices. According to WordPress.org, the free version already lists support for ZUGFeRD 1.0/2.0 and Factur-X (the French equivalent to ZUGFeRD).

- E-Invoice: The free version already lists support for ZUGFeRD 1.0/2.0 and Factur-X (the French equivalent to ZUGFeRD). This is a strong argument for budget-conscious users.

- Disadvantage: It only handles invoices. For legal compliance of the checkout (button solution, T&C checkboxes), you still need a plugin like Germanized (Basic).

- Design: Very flexible with HTML/CSS customization.

Comparison Table: Plugins for 2025

| Feature | Germanized Pro | German Market | PDF Invoices & Packing Slips |

|---|---|---|---|

| ZUGFeRD Support | ✅ Yes (Comprehensive) | ✅ Yes (Integrated) | ✅ Yes (Basic) |

| XRechnung Support | ✅ Yes | ✅ Yes | ⚠️ Partial via add-on |

| Shop Legal Compliance | ✅ Complete solution | ✅ Complete solution | ❌ Invoice only |

| Price (approx.) | €79/year | €75/year | Free (Basic) / €59 (Pro) |

| Recommended for | All-in-one seekers | Agencies & developers | Budget-conscious & designers |

Solution B: External Accounting Software (For Growing Companies)

Beyond a certain size (approx. 50+ orders per month), WordPress plugins reach their limits. The database fills up, and your tax advisor complains about the "paper chaos." This is where external tools come into play – concepts also applicable when using Shopware Flow Builder for automation.

Why Use External Tools?

Instead of creating the invoice in WooCommerce, WooCommerce sends the order data to software like sevDesk, Lexoffice, or FastBill. This software then creates the invoice.

- Advantage 1: Tax advisor love. These tools have DATEV interfaces. Your tax advisor can pull the data directly.

- Advantage 2: GoBD archiving. External tools often guarantee audit-proof archiving better than a WordPress server.

- Advantage 3: Banking. Automatic reconciliation of incoming payments with open invoices.

The Top Providers & Integrations

1. sevDesk: Very popular with e-commerce startups. Integration via the "Germanized Pro" plugin or official connectors. Full support for ZUGFeRD and XRechnung according to sevDesk and E-Rechnung Einfach Sicher.

2. Lexoffice: Market leader in the small business/SME sector (Haufe Group). Integration via plugins like "Woolex" or Germanized. According to Woolex, it automatically creates ZUGFeRD documents.

3. FastBill: Focus on automation and design. Also supports ZUGFeRD and XRechnung as confirmed by Tax-Tech.

Threshold where plugin solutions start showing limitations

Extended e-invoice deadline applies below this revenue

Legal requirement for invoice archiving in Germany

Average reduction in manual bookkeeping with automation

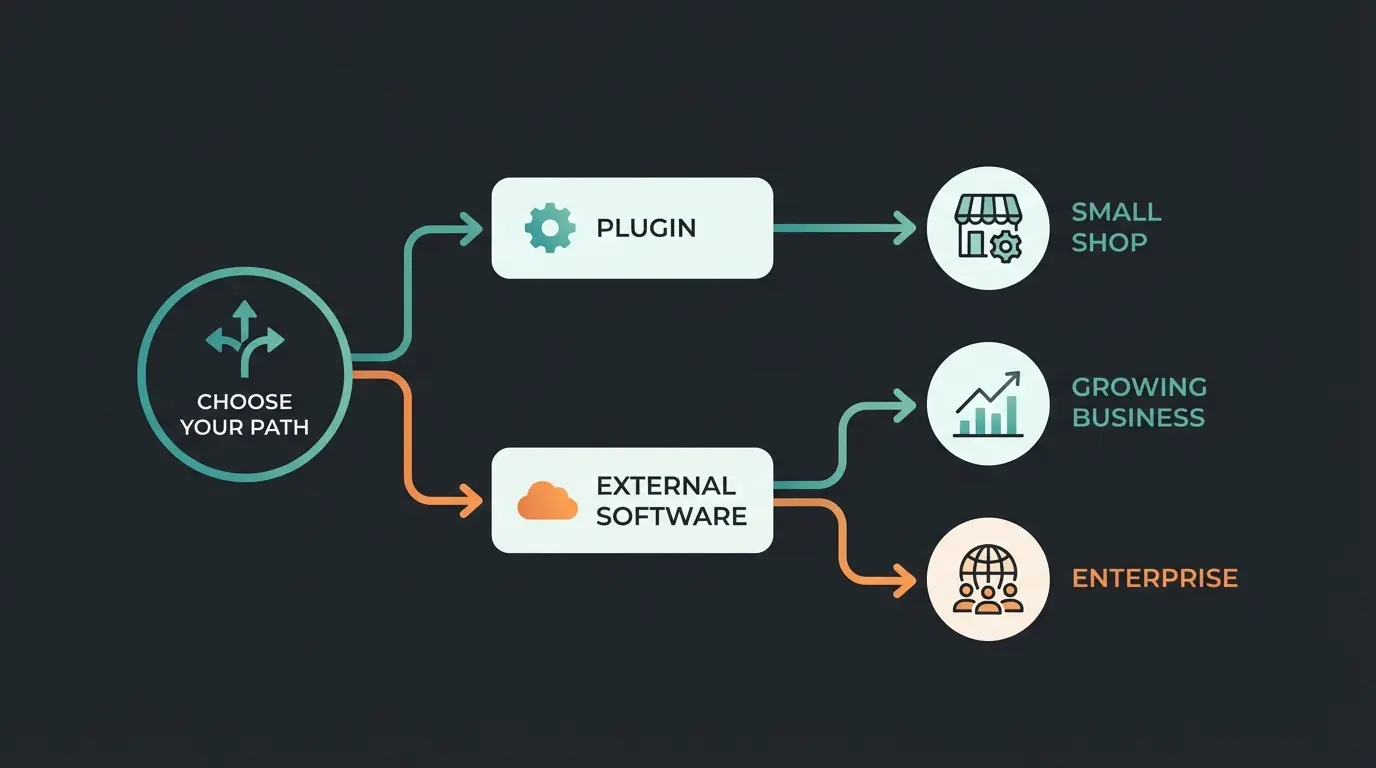

Decision Helper: Which Path is Right for You?

Are you unsure whether you need a plugin or external software? Use this decision tree. These same decision-making principles apply when exploring Shopware 6 features for your e-commerce platform choice.

Question 1: How many invoices do you write per month?

- Less than 50: → Plugin solution (Cheaper, everything in one place).

- More than 50: → External software (Better overview, banking reconciliation).

Question 2: Do you sell B2B (to companies)?

- Yes: → You absolutely need ZUGFeRD/XRechnung support (Germanized Pro, German Market, or external software).

- No (B2C only): → A simple PDF plugin is sufficient for now (but be careful with growth).

Question 3: How do you work with your tax advisor?

- I send them a shoebox/PDFs: → Plugin is sufficient.

- They use DATEV Unternehmen Online: → External software (Lexoffice/sevDesk) saves you massive tax advisor costs through export interfaces.

While you optimize your backend with invoice automation, discover how AI-powered product consultation can transform your frontend sales experience.

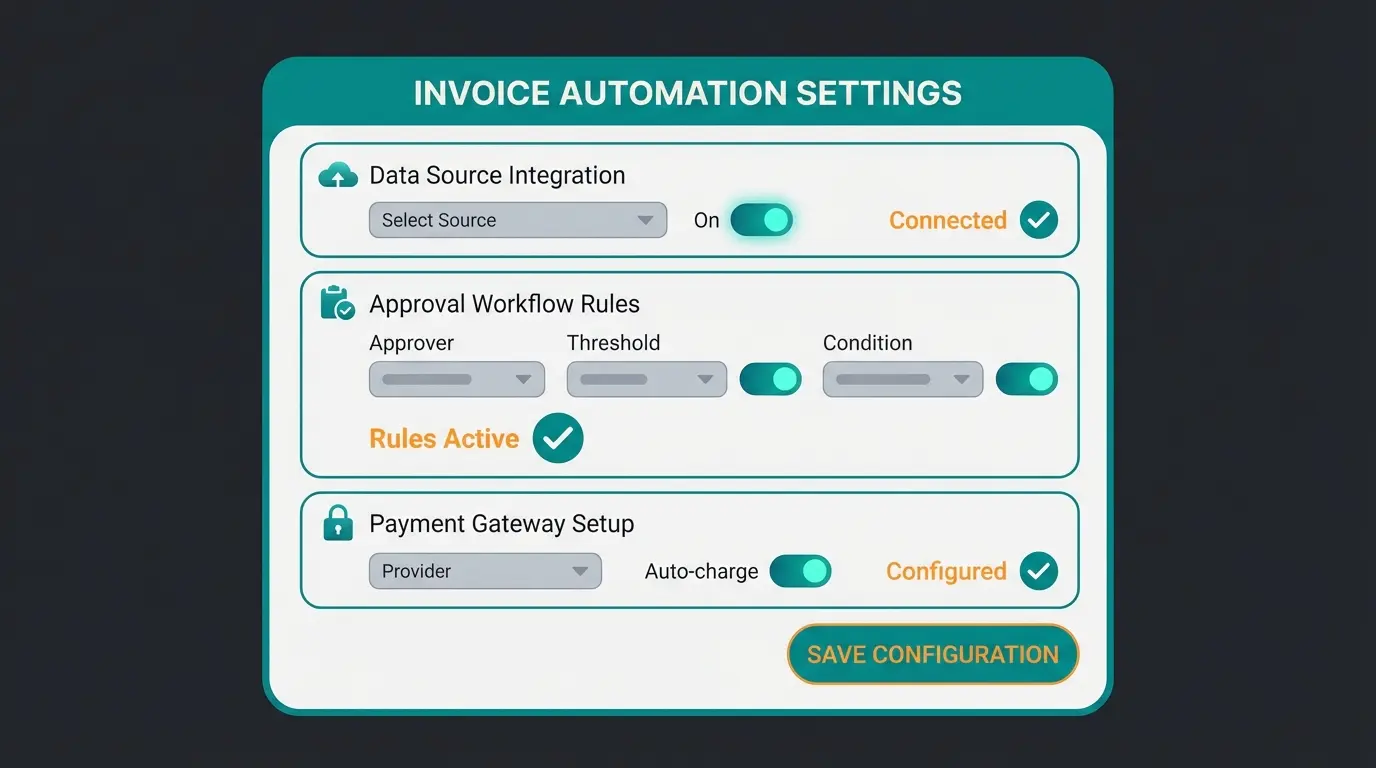

Explore AI SolutionsStep-by-Step Guide: Setting Up E-Invoice with Germanized

Assuming you choose the popular Germanized Pro solution. Here's how to set up e-invoicing for 2025:

Step 1: Installation & Activation

Install Germanized Pro and activate your license. In the WordPress dashboard, go to `WooCommerce > Settings > Germanized`.

Step 2: Open Invoice Settings

Navigate to the `Invoices & Delivery Notes` tab. Here you enable PDF invoice creation. Make sure "Automatic creation" is active for the status "Completed" (and possibly "Processing").

Step 3: Activate E-Invoice

Go to the `E-Invoice` submenu (often a separate tab or section in the Pro version).

- Choose format: Select "ZUGFeRD (Comfort)" or "ZUGFeRD (Extended)". The "Extended" profile offers the highest compatibility as confirmed by Vendidero.

- Automation: Check the box for "Automatically create/attach e-invoice".

- Validation: Germanized checks whether your company data is complete (VAT ID, company name, address). Missing data leads to invalid XML files.

Step 4: Test Order

Place a test order and check the email sent to the customer. Open the PDF.

Beyond Accounting: Total Automation for Your Shop

Congratulations! If you've followed along this far, you've automated the "boring" administrative part of your shop. Your invoices write themselves, the tax office is happy, and you save hours of office work every week.

But what do you do with the time you've gained?

Most store operators put this time back into manual work: answering customer inquiries. "Does this replacement part fit my model?" "What size do I need?" "When will my delivery arrive?" This is where AI product consultation becomes invaluable.

Here lies the true potential of automation. While tools like Germanized or sevDesk clean up your backend (administration), modern AI solutions can revolutionize your frontend (sales & support). Consider how AI Chatbots are transforming customer interactions across industries.

Imagine you had an employee who greets every visitor on your site personally, explains products as if they had developed them themselves, and answers invoice questions ("Where's my invoice?") instantly by directing customers to their account portal. This is exactly what an intelligent sales consultant can deliver for your business.

From Admin Bot to Sales Agent

Automating invoice creation is the mandatory part ("Admin AI"). The freestyle is Sales AI. By using AI chatbots trained on your product data, you close the gap. You automate not only the costs (invoices) but also the revenue (consultation). The success of the AI employee Flora demonstrates the real-world impact of this approach.

Think about it: If your accounting is now on autopilot – why should your sales still be manual work? An AI-powered sales consultant can handle the heavy lifting of customer engagement while ensuring GDPR compliant chatbot implementation protects customer data.

When implementing AI solutions, it's important to understand the regulatory landscape, including the EU AI Act requirements that affect how businesses deploy AI tools. Having AI product consultation not only improves customer experience but also supports your SEO and conversion goals.

FAQ & Checklist for 2025

No. For end consumers, nothing changes. You can continue to send normal PDF invoices. ZUGFeRD invoices don't hurt though, as they look like normal PDFs to the recipient.

Yes. You need a "connector" (connection plugin) that pushes data from WooCommerce to Lexoffice. Lexoffice itself cannot directly "reach into" your shop.

From 2025 (or after the transition periods expire), you risk your B2B customers rejecting your invoices because they cannot claim input tax deduction. This leads to payment delays and business losses.

We recommend ZUGFeRD Extended for maximum compatibility. The Comfort profile works for most use cases, but Extended ensures your invoices are accepted by all compliant accounting systems.

Yes, but plan the transition carefully. Export your existing invoice data, ensure number sequences remain intact, and test thoroughly before going live with the new system.

Your 2025 Compliance Checklist

Copy this list and go through it point by point:

- ☐ Plugin check: Does my current invoice plugin support ZUGFeRD/XRechnung?

- ☐ Update: Have I installed the latest version (e.g., Germanized Pro 4.0+)?

- ☐ Master data: Is my company data (VAT ID, address, legal form) correctly stored in the shop?

- ☐ Number ranges: Are my invoice numbers sequential and without gaps (separate from order numbers)?

- ☐ Archiving: Do I have a concept for storing digital invoices audit-proof for 10 years?

- ☐ B2B validation: Do I check the VAT ID for B2B customers (VIES check) to correctly apply reverse charge?

Conclusion: From Compliance Burden to Competitive Advantage

The topic of "WooCommerce invoice creation" initially appears dry and bureaucratic. But with the right tools (Germanized, German Market, or external providers), the tedious obligation becomes an automated process. Use the transition to e-invoicing in 2025 as an opportunity to position your shop more professionally – and then devote yourself again to what really matters: your products and your customers.

Remember: invoice automation is just the beginning. The real transformation happens when you apply the same automation mindset to your entire customer journey – from the first website visit to post-purchase support. The shops that thrive in 2025 and beyond will be those that automate intelligently across both their backend operations and frontend customer experience.

You've mastered invoice automation. Now discover how AI-powered product consultation can boost your conversions while you focus on growing your business.

Start Your AI Journey