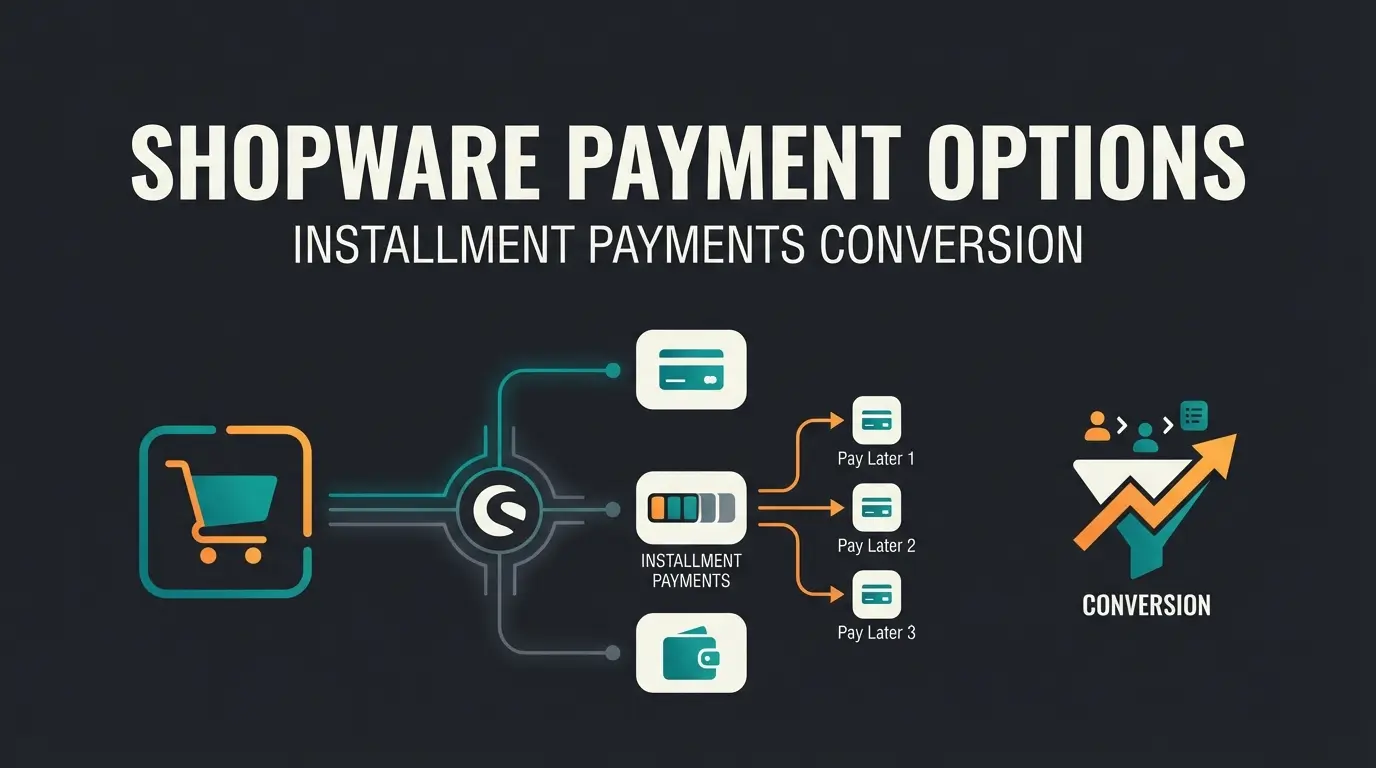

Why Klarna Is Essential for Shopware Stores

In German e-commerce, there's an unwritten rule: If you don't offer invoice payment (Rechnungskauf), you're leaving money on the table. Germany is unique worldwide in its preference for 'goods first, payment later.' Klarna has established itself as the de-facto standard to fulfill this need while remaining risk-free for merchants.

For Shopware merchants, the equation seems simple at first glance: Shopware + Klarna = More Revenue. However, the reality is more complex. While technical integration is often marketed as 'plug-and-play' thanks to plugins, forums and support tickets paint a different picture. Error codes like '401 Unauthorized,' checkout visibility issues, or B2B customer conflicts frustrate shop operators, as documented on Shopware's official documentation.

Even more serious is a strategic problem that few agencies discuss: the 'Returns Trap.' By extremely simplifying the payment process ('Pay Later'), customers tend to use their shopping cart as a 'fitting room.' They order three sizes, knowing they don't have to pay until they return two of them. When choosing the right Shopware payment plugins, understanding this dynamic is crucial.

This guide differs from standard tutorials. We'll walk you through the error-free installation in Shopware 6 step by step and provide you with the troubleshooting checklist for the most common errors. Most importantly, we'll show you how to solve the 'Klarna Paradox': Maximum conversion through Klarna while minimizing returns through intelligent AI consultation.

The Data: Why You Need Klarna (And What It Costs)

Before diving into the technical aspects, let's examine the numbers. Why is the pressure to integrate Klarna so high?

Conversion and Average Order Value Impact

Studies and data from Klarna itself show impressive uplifts for merchants offering BNPL (Buy Now, Pay Later). According to research from FedEx and industry analysis from How They Grow, the benefits are substantial:

BNPL options reduce checkout friction significantly

Deferred payment encourages larger purchases

Klarna users return and buy more often

The reason for these impressive numbers is the reduction of 'friction' at checkout. Customers don't need to search for credit card details or generate TANs. When the pain of immediate cash outflow is removed ('Pay in 30 days'), spending becomes easier. Research from Embryo and Guidance confirms these metrics across multiple markets.

Trust Factor in the DACH Region

In Germany, invoice payment isn't just a payment method—it's a trust signal. A shop offering Klarna communicates: 'We're legitimate, you're taking no risk.' Especially for new customers unfamiliar with your brand, this is often the deciding factor. For comprehensive Shopware checkout optimization, understanding regional payment preferences is essential.

The Downside: The Returns Explosion

Here lies the strategic risk. Data from the University of Bamberg (Returns Research) and Retourenforschung.de shows clearly that the Alpha return rate (probability of a package being returned) for invoice payment in the fashion sector is approximately 55.65%. For comparison: prepayment results in only about 30%.

Interim Conclusion: You can't avoid Klarna if you want to grow. But you need a strategy to manage the side effects (returns). More on this in Section VI.

Step-by-Step: Installing Klarna in Shopware 6

Klarna integration in Shopware 6 today primarily happens through the 'Klarna Payments' plugin. Note: The older 'Klarna Checkout' plugin is used less frequently since Shopware 6 has its own strong checkout into which 'Klarna Payments' integrates seamlessly, as explained by Mollie.

Step 1: Plugin Download and Installation

There are two ways to get the plugin into your shop:

Option A: Via Shopware Admin (Recommended for Merchants)

- Log into your Shopware 6 admin area

- Navigate to Extensions > Store

- Search for 'Klarna Payments'

- Click 'Install App'

- After installation, find the plugin under Extensions > My Extensions

- Click the toggle to activate the plugin

This process is documented in detail in Shopware's official guides and through YouTube tutorials from Shopware Knowledge.

Option B: Via Composer (For Developers)

For complex deployments or agencies, the terminal approach is cleaner. Run the following commands to install and activate the Klarna Payment plugin: `composer require store.shopware.com/klarnapayments`, then `bin/console plugin:refresh`, followed by `bin/console plugin:install --activate KlarnaPayment`, and finally `bin/console cache:clear`.

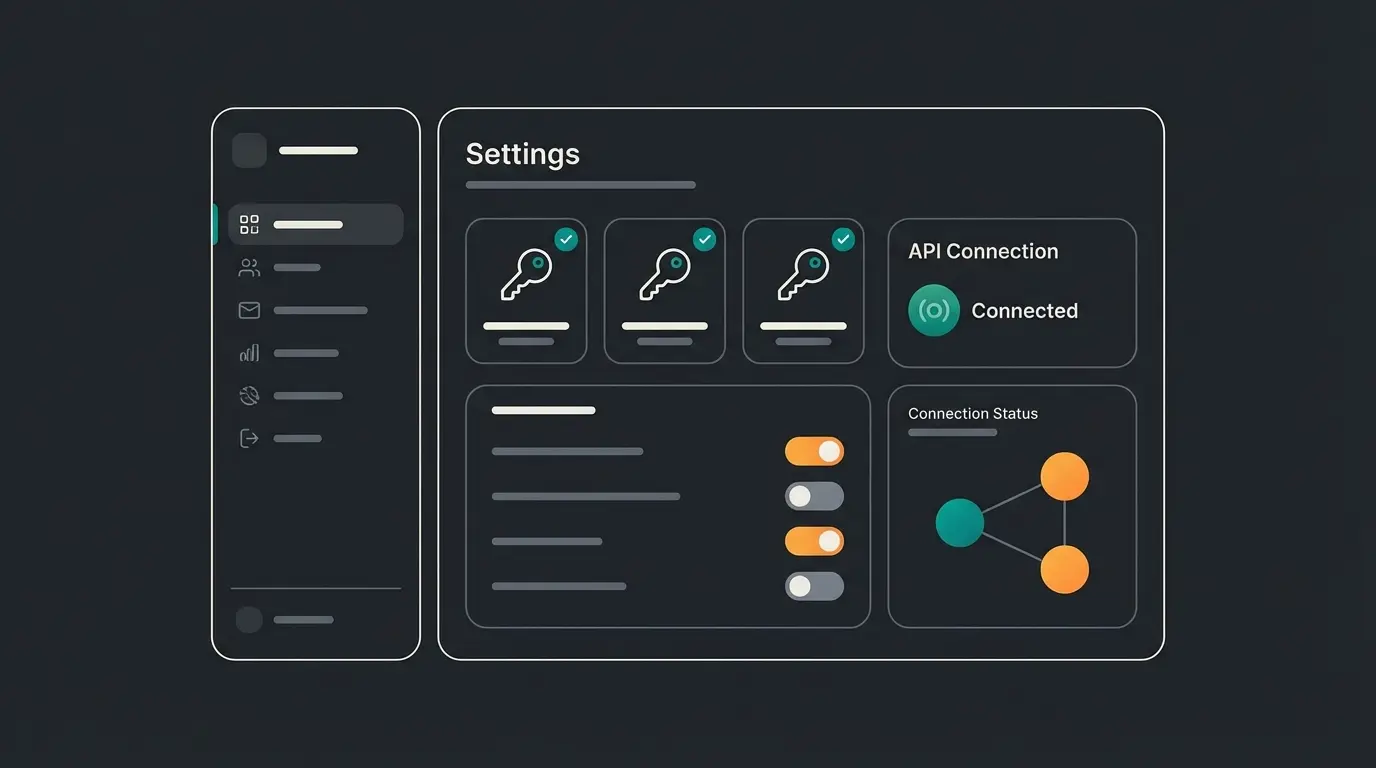

Step 2: Obtaining API Credentials

The plugin alone isn't enough—it needs to communicate with your Klarna merchant account.

- Log into the Klarna Merchant Portal (portal.klarna.com)

- Go to Settings > Klarna API Credentials

- Click 'Generate New API Credentials'

- IMPORTANT: Download the `.txt` file with username (UID) and password. You'll only see it once!

Step 3: Configuration in Shopware Admin

- Go to Settings > Extensions > Klarna Payments in Shopware

- Select Sales Channel: You can configure Klarna globally or per sales channel (e.g., only for the German shop)

- API Mode: Choose 'Live' or 'Test' (Playground)

- Enter Credentials: Copy username and password from Step 2 into the corresponding fields

- API Test: Click 'Test API Credentials.' If a green checkmark appears, the connection is established

This configuration process is detailed in guides from Solution25 and other integration specialists.

Step 4: Activating and Assigning Payment Methods

A common mistake: The plugin is installed, but payment methods aren't visible.

- Go to Settings > Payment Methods. You should now see new entries like 'Pay Later with Klarna' (Rechnung), 'Slice It with Klarna' (Ratenkauf), and 'Pay Now'

- Activate the desired methods (set status to 'Active')

- Assign to Sales Channel: Go to your sales channel (left sidebar) > 'General' tab

- Under 'Payment Methods,' add the Klarna methods and save

Troubleshooting: Common Shopware Klarna Issues

Even when following instructions correctly, errors often occur. Google search results are full of desperate merchants. Here's the consolidated solution table for the most common problems, based on technical analysis and forum data.

The Ultimate Klarna Error Cheat Sheet

| Error / Symptom | Likely Cause | Solution / Quick Fix |

|---|---|---|

| 401 Unauthorized | Wrong API data or wrong mode | Classic mistake: Using 'Playground' data in 'Live' mode (or vice versa). Check if the 'Test Mode' toggle in the plugin matches the credentials URL. Username often starts with 'K...' for Live. Watch for spaces when copying! |

| Payment method not visible in checkout | Missing assignment or currency issue | 1. Check if payment method is assigned in sales channel. 2. Check Rule Builder: Are there rules (e.g., 'Cart > €200') hiding the payment method? 3. Currency: Klarna often requires local currency (EUR). Is EUR active in sales channel? |

| 'Something went wrong' (General) | API limit or cache | Clear Shopware cache (`bin/console cache:clear`). Check logs under `var/log/`. Often timeout issues or outdated plugin versions. |

| 400 Bad Value / Bad Request | Address data formatting | Klarna is strict with addresses. If a customer writes 'Packstation' in the street field, the API rejects it. Check if address validation plugins are interfering, as noted in Klarna's API documentation. |

| B2B customers can't pay | Klarna is primarily B2C | Klarna supports B2B only very limitedly (specific countries/configurations). Solution: Use the Billie integration within the Klarna plugin for B2B invoice payment, as documented in Shopware's B2B guides. |

| 403 Forbidden | Account not activated | Your credentials are correct, but Klarna hasn't activated your merchant account for certain products (e.g., installment payment). Contact Klarna Merchant Support, as explained in HelpScout documentation. |

Understanding these common errors is essential for AI-powered prevention of checkout abandonment caused by payment failures.

Pro Tip: Using On-Site Messaging Correctly

Many merchants forget 'On-Site Messaging' (OSM). These are the small widgets on the product detail page ('Pay from €15/month').

Why use it? It increases conversion because customers see before checkout that they can afford the product. Setup: Activate it in the Klarna plugin under 'On-Site Messaging.' You often need to include the 'Data Client ID' script in the theme if the plugin doesn't do this automatically (for custom themes), as shown in tutorials on YouTube and Create.net guides.

Our AI assistant can guide your customers through the checkout process, reducing support tickets and abandoned carts caused by payment confusion.

Start Free TrialThe Hidden Danger: Klarna, BNPL, and the Returns Spiral

You've installed Klarna, fixed the 401 error, and orders are coming in. All good? Not quite.

The Psychological Phenomenon of 'Selection Ordering'

Klarna 'Pay Later' (invoice payment) decouples the purchase decision from the pain of payment. This leads to behavior that would be impossible in brick-and-mortar retail: The customer buys out half the store to select at home.

According to research from Sendcloud and Neocom, in the fashion sector, approximately 50% of all packages are returned. The cost per return averages between €5 and €10 (shipping, inspection, refurbishment, value loss)—often even more, according to EHI. Implementing AI customer service can help address customer concerns before they lead to returns.

Fashion sector, compared to 30% with prepayment

Shipping, inspection, refurbishment, value loss

Average in fashion e-commerce with BNPL

If Klarna increases your revenue by 20% but your return rate skyrockets from 20% to 40%, net profit can actually decrease. Many Shopware merchants only see the revenue uplift in their analytics ('Hooray, more sales!') but overlook the exploding process costs in the warehouse that only appear in financial statements weeks later.

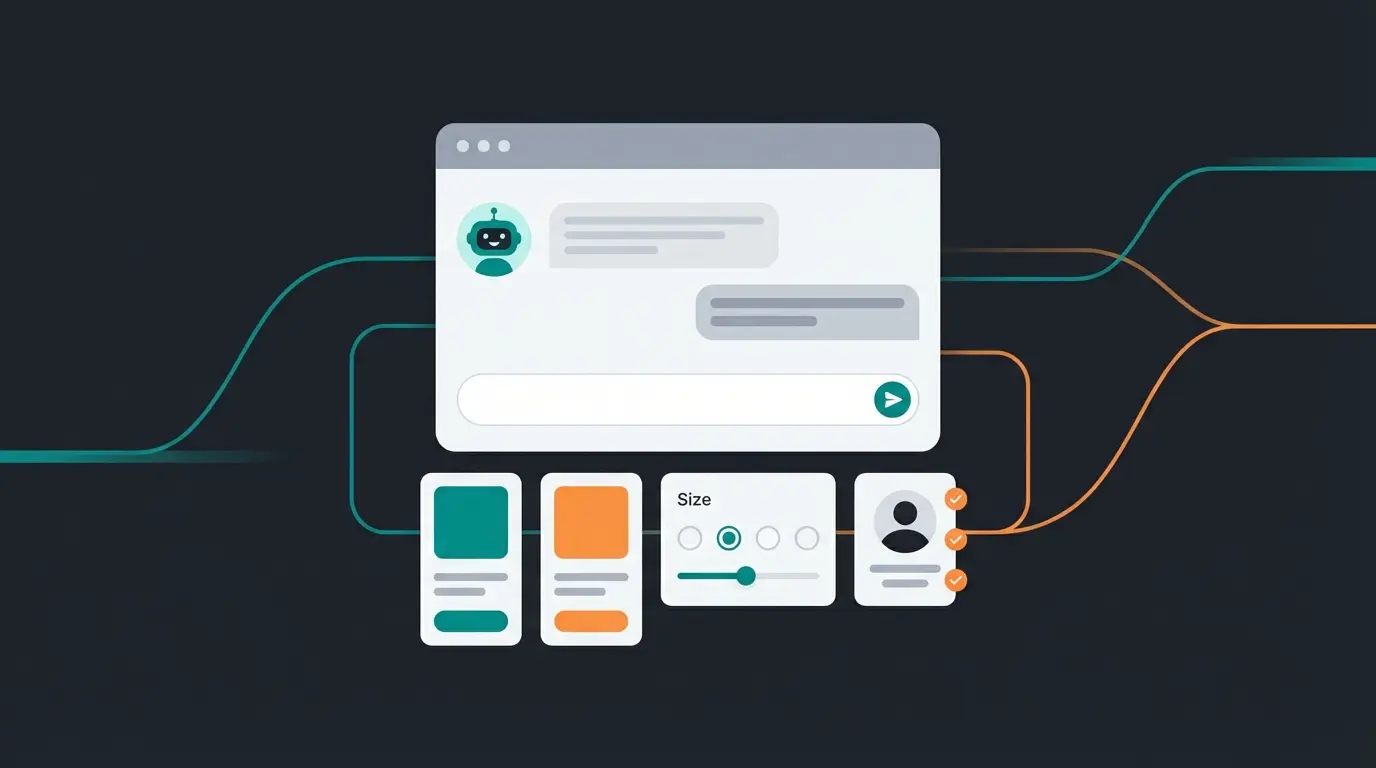

The Gap in Shopware Standard Setup

Shopware 6 is an excellent shop system, and Klarna is an excellent payment provider. But neither solves the core problem: Customer uncertainty.

The customer orders three sizes because they don't know which fits. They order two colors because they don't know how they'll look in reality. Klarna merely finances this uncertainty. This is where AI-powered product consultation becomes essential for addressing the root cause.

The Solution: AI Product Consultation as 'Returns Stopper'

This is where the decisive competitive advantage comes into play. To solve the 'Klarna Paradox,' you need to intervene before the customer clicks 'Buy.' You must complement the security Klarna provides at payment with security in product selection.

How AI Closes the Gap

Modern AI solutions (like our AI Product Consultation) function as digital sales consultants in the Shopware store. Unlike static size charts or FAQ bots, AI conducts a dialogue with the customer. For detailed insights into this approach, explore our comprehensive AI product consultation guide.

The Scenario:

Without AI + Klarna: Customer sees pants. Uncertain about size. Thinks: 'Whatever, I'll take M and L, Klarna pays for now anyway.' -> Result: 1 Sale, 1 Return.

With AI + Klarna: Customer sees pants. AI chat asks: 'How tall are you? What fit do you prefer?' AI analyzes product data and customer response. Recommendation: 'Take size M, it runs loose.' Customer only buys M. -> Result: 1 Sale, 0 Returns.

AI assistant helps select the perfect size/variant, reducing return risk

Customer adds the right product with confidence

Frictionless payment increases conversion

High sales + Low returns = Maximum profit

Comparison: Standard vs. AI-Optimized Checkout

| Metric | Standard Shopware + Klarna | Shopware + Klarna + AI Consultant |

|---|---|---|

| Conversion Rate | High (easy payment) | Very High (payment + consultation confidence) |

| Average Order Value | High (installment payment) | High (targeted cross-selling by AI) |

| Return Rate | Critically high (selection ordering) | Low (precise selection) |

| Customer Satisfaction | Medium (returns annoy customers too) | Excellent (product fits immediately) |

This comparison demonstrates why combining AI-powered Guided Selling with Klarna creates a winning strategy. The key is addressing uncertainty at the source.

Integration into Your Strategy

The combination is key. Use Klarna to lower the barrier at checkout (conversion). Use AI to lower the barrier at decision-making (return prevention). Understanding how AI consultation transforms customer interactions is crucial for implementing this approach effectively.

The AI takes on the role of the experienced salesperson in a physical store who prevents the customer from going into the fitting room with five wrong items. For deeper insights into measuring this impact, review our guide on AI product consultation cost savings.

Your Success Roadmap and Implementation Checklist

Klarna integration in Shopware 6 is no longer a 'nice-to-have' in 2024—it's mandatory for success in the DACH market. The technical hurdles are manageable thanks to good plugins and our troubleshooting table above.

But technology is only half the battle. Anyone who blindly activates Klarna risks drowning in the flood of returns encouraged by 'Pay Later' options.

Your Roadmap to Success

- Installation: Install the 'Klarna Payments' plugin cleanly via the Shopware Store

- Testing: Use Playground mode to run through the complete checkout flow (including error cases)

- Configuration: Activate 'On-Site Messaging' to advertise installment payments on the product page

- B2B Check: If you sell to businesses, activate the Billie integration in the plugin

- Returns Protection: Implement AI product consultation to proactively intercept the return tendency created by Klarna

Following this checklist while implementing proper Shopware SEO guide practices ensures your store is optimized for both discovery and conversion.

Frequently Asked Questions About Shopware Klarna

This is usually caused by missing sales channel assignment or currency mismatches. First, verify the payment method is assigned to your sales channel under Settings > Sales Channels. Then check if EUR is active as the currency. Also review your Rule Builder for any conditions that might hide payment methods based on cart value or customer groups.

The 401 error almost always means credential mismatch. You're likely using Playground (test) credentials in Live mode or vice versa. Verify your API mode setting matches your credentials source. Also check for accidental spaces when copy-pasting credentials, and ensure your merchant account is fully activated for the products you're trying to offer.

Klarna primarily supports B2C transactions. For B2B invoice payment in Shopware, activate the Billie integration within the Klarna plugin. Billie specializes in B2B payment solutions and integrates seamlessly with the existing Klarna infrastructure in Shopware 6.

Studies show that Buy Now Pay Later options like Klarna significantly increase return rates. In fashion, the return rate with invoice payment reaches approximately 55.65%, compared to only 30% with prepayment. This happens because customers feel comfortable ordering multiple variants to try at home without immediate financial commitment.

Combine Klarna's payment convenience with AI-powered product consultation. While Klarna removes friction at checkout (boosting conversion), AI consultation removes uncertainty during product selection (reducing returns). This dual approach lets you capture the conversion benefits while preventing the return costs that typically accompany BNPL options.

Our AI Product Consultation helps your customers find the perfect product before checkout—reducing returns by up to 30% while keeping Klarna's conversion benefits.

Get Started Free